NASCUS ’21 S3: Ito opens ‘21 Summit with look at state system’s performance

(Aug. 20, 2021) State credit unions are growing their assets and members, spurred to some extent by the financial impact of the COVID-19 pandemic, NASCUS President and CEO Lucy Ito told the opening session of the NASCUS 2021 State System Summit (S3) Tuesday.

Ito’s remarks were among the first at the S3 conference, which assembled a diverse group of more than 115 attendees throughout the country, including state regulators, credit unions, industry partners, and the media. The annual event serves as the state system’s annual conference, and offers a unique opportunity to bring together credit union regulators and practitioners for open dialogue and mutual exchange.

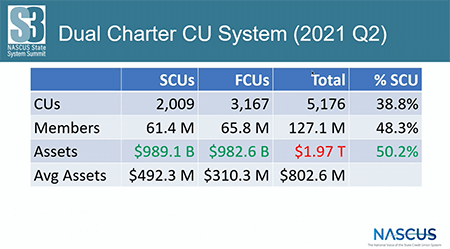

Ito indicated that state credit union asset growth of 21.3% from the end of the first quarter 2020 to end of first quarter 2021 (to $989.1 billion) was astronomical but not surprising, given the influx of savings most financial institutions experienced related to the financial impact of the coronavirus crisis. However, she did say that the membership growth of 3.67% for the period (to 61.4 million) – and decline in the number of state credit unions by just more than 2% (to 1,009) — was typical for the state system.

She noted that the consolidation of credit unions over the last three years, however, has slowed slightly. At year-end 2018, she said, the number of state credit unions dropped by 3.6%; the rate slowed to 2.3% in 2019. Last year, the number dropped at an even slower rate of 2.2%. “Possibly into 2021, consolidation could be slowed a bit in that credit unions may not be pursuing mergers given the other things that they are dealing with,” she said.

Notably, Ito reported, the state system at the end of the first quarter held slightly more than half (50.2%) of all assets in the whole credit union system; memberships were just under the halfway mark, she said, at 48.3%. Overall, two out of every five credit unions (38.8%) are state credit unions. However, state credit unions on average are larger than their federal brethren, at $492.3 million in assets, compared to $310.3 million for FCUs, she pointed out.

On conversions of charters, Ito said over the last 13 years (as of the end of the second quarter of each year), more credit unions (103) with more assets (about $60 billion) have converted from federal to state. She noted, however, that since 2016 when NCUA approved modernization of its field of membership rules for FCUs, that more credit unions have been converting from state to federal (50 conversions to federal charter, versus 40 to states). Those totals include the first two quarters of this year.

However, states continued to gain more assets in the conversions over that time period: $26.4 billion compared to $17 billion for conversions to federal. But that trend may be about to change. So far in 2021, she pointed out, there have been seven conversions, with four of those from state to federal and accounting for $2.4 billion in assets. The three federal to state conversions, she noted, totaled only $328.5 million in assets. “It makes me wonder if this is a turning point in conversions,” she said.

“At this time we have a state and federal system that is basically 50-50,” Ito said. “As we look to the future, factors that will affect future trends (of the share of the market) include continued mergers depending on the size of those and whether or not they change charters; conversions; interstate operations as state borders become less important in people’s lives; and field of membership flexibility.”

She said that, historically, when federal credit unions have converted to states, it is because of the field of membership flexibility that is available in some states, especially the ability to mix and match geographic community fields of membership with associations or with select employee groups.

In other comments, Ito asserted that charter competitiveness within the states will be a key to future growth and success. She noted that parity between credit union charters within states – and even parity between charters of other states (for at least five states: Connecticut, Idaho, Texas, Utah and Washington) or other financial institutions – will play an increasingly large role for states.

“Competitiveness is key; credit unions do need to be able to keep up and compete,” Ito said. “Certainly, as all of us experienced both in our professional and personal lives during the pandemic, just the digitization of our lives accelerated and certainly the pressures on credit unions and other depositories has grown much more intense.”