Difficulty Paying Bills Tops Pandemic High in US Census Survey

(Bloomberg) — The share of Americans who report having difficulties paying their bills has surpassed its 2020 pandemic peak in a US Census Bureau survey, underscoring the toll of soaring prices on budgets.

(Bloomberg) — The share of Americans who report having difficulties paying their bills has surpassed its 2020 pandemic peak in a US Census Bureau survey, underscoring the toll of soaring prices on budgets.

Four in ten adults said it has been somewhat or very difficult to cover usual household expenses in a poll conducted end of June and early July. That’s the highest since the Census started asking the question in August 2020. It implies that more than 90 million families are struggling, up from about 60 million a year ago.

When the Census first asked the question two years ago, a third of respondents reported difficulties in covering usual household bills. The share fell over the following year but started rising about a year ago after government pandemic relief ended and inflation took hold.

Millions of households with student loans are expected to face an additional monthly expense Sept. 1, when a Covid moratorium on servicing that debt ends.

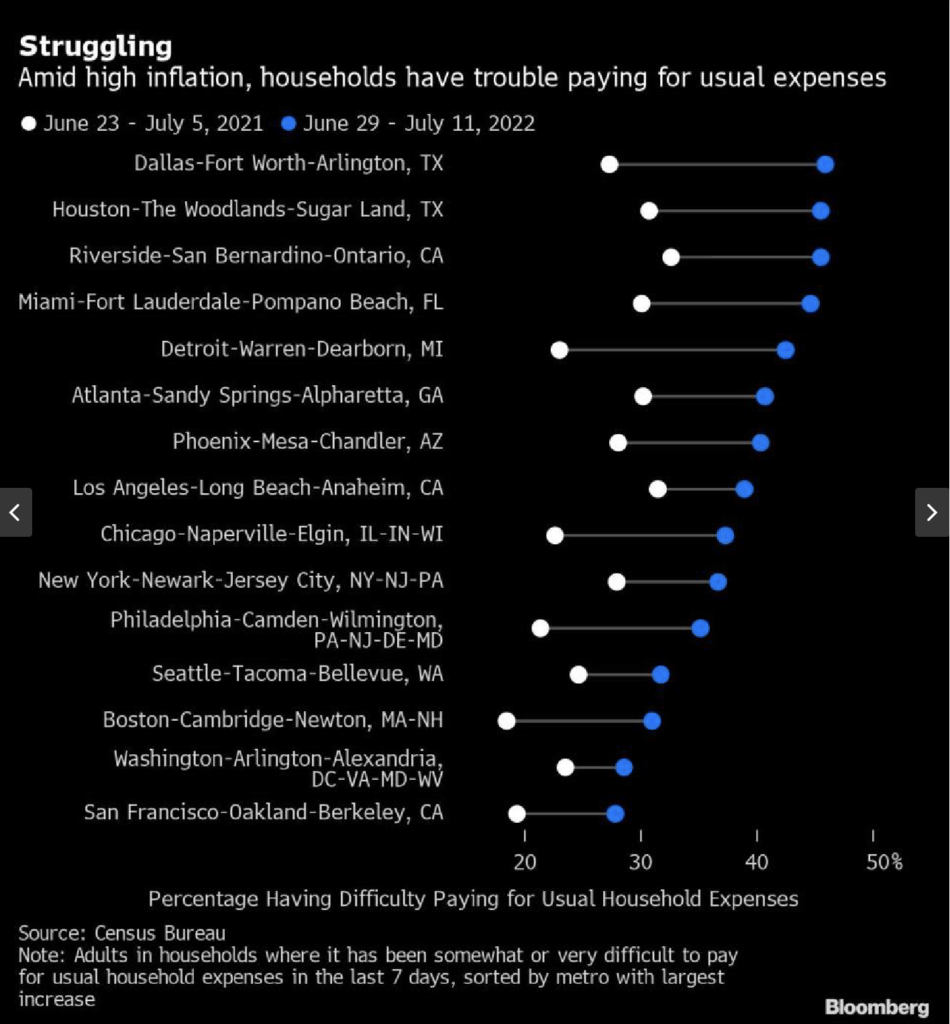

The survey shows a sharp increase in financial stress in all of the country’s large metropolitan areas. In Dallas, for example, the share of respondents having difficulty paying bills jumped to about to 45.9% from 27.9% a year earlier. The share in Detroit rose by almost 20 percentage points.

A report last week from New York State Comptroller Thomas P. DiNapoli showed that one in eight residents were behind on paying their utility bills as of March. More than 1.2 million customers statewide owed $1.8 billion, with residents of New York City and Long Island accounting for 68% of the total.

The average amount owed by residents in the state doubled in two years, to $1,467 in March from $768 in March 2020.

“The pandemic’s effects continue to be felt in multiple aspects of life, including the elevated number of New Yorkers who continue to have trouble paying their utility bills,” DiNapoli said in the report.

Nationally, the latest Census survey shows that more than one third of households reduced or forwent expenses for basic household necessities, such as medicine or food, in order to pay an energy bill. More than one in five families kept their home at a temperature that felt unsafe or unhealthy for at least one month, and a similar share hasn’t been able to pay at least part of an energy bill.