Buy Now, Pay Later: Who Uses It and Why

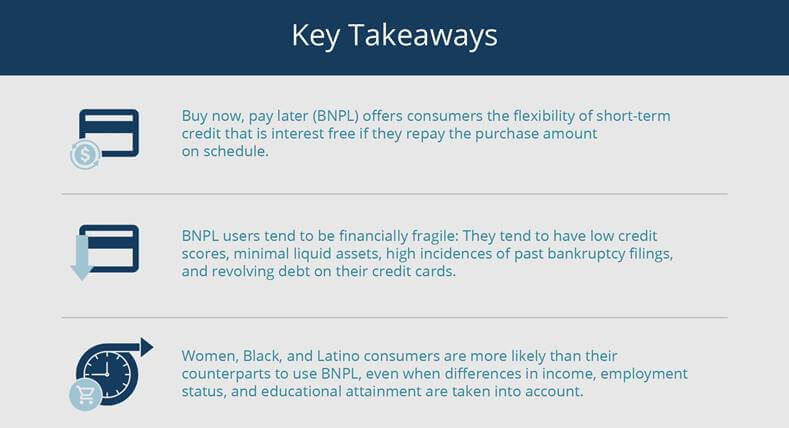

Buy now, pay later (BNPL), a short-term, interest-free credit option for retail purchases, is becoming increasingly popular, and evidence indicates that its use is significantly higher among financially vulnerable consumers and disproportionately high among women, Black, and Latino consumers. At roughly 9 percent (as of fall 2023), the share of all consumers using BNPL is still relatively low, but it has increased about 40 percent from two years earlier.

Buy now, pay later (BNPL), a short-term, interest-free credit option for retail purchases, is becoming increasingly popular, and evidence indicates that its use is significantly higher among financially vulnerable consumers and disproportionately high among women, Black, and Latino consumers. At roughly 9 percent (as of fall 2023), the share of all consumers using BNPL is still relatively low, but it has increased about 40 percent from two years earlier.

BNPL is offered by retailers through payment platforms such as Affirm, Klarna, or Afterpay. Consumers can use the service to make online or in-store purchases and repay only their purchase amount in installments over a short period, typically four installments over six weeks. Consumers do not pay any interest as long as they make their payments on time.

BNPL can thus provide short-term credit to consumers who lack alternative sources of credit, may not have credit cards, or have low credit limits. In addition to retailers offering BNPL, many credit card issuers offer their cardholders an opportunity to split purchases into installments after the purchase. The market is constantly evolving, addressing changing consumer needs and market conditions. On May 22, 2024, the Consumer Financial Protection Bureau (CFPB) announced that BNPL lenders will be classified as credit card providers, which will allow consumers to dispute charges and demand refunds from lenders after returning products purchased with a BNPL loan.

While BNPL provides consumers with flexibility and offers attractive payment alternatives, concerns have arisen about the potential risk to consumers who accumulate too much debt (CFPB 2022, 2023). Most BNPL companies recently tightened their lending criteria in response to rising delinquencies. These precautions are consistent with findings from recent reports by the CFPB and the Federal Reserve Bank of New York (Aidala et al. 2023), which show that consumers who use BNPL are more likely to be financially fragile. Despite these concerns, BNPL loans are not reported in consumers’ credit reports or reflected in their credit scores, including FICO scores, which this brief uses in its analysis.2

This brief uses data from the 2023 Survey and Diary of Consumer Payment Choice (SDCPC)3 to show that consumers who use BNPL tend to have very low credit scores, are more likely than other consumers to have filed for bankruptcy during the previous year, have low checking account balances, and are much more likely than other consumers to revolve on their credit cards, that is, to carry a balance from month to month. Given these consumers’ financial vulnerabilities, extensive or prolonged use of BNPL could worsen their financial situation…Read more