CFPB To Distribute Over $8 Million To Consumers Harmed by All American Check Cashing, Inc.

I n July, 43,647 consumers harmed by All American Check Cashing, Inc., will begin receiving refund checks in the mail.

n July, 43,647 consumers harmed by All American Check Cashing, Inc., will begin receiving refund checks in the mail.

The CFPB took action against the check cashing and payday loan company All American and its owner, Michael Gray, alleging that All American failed to disclose the cost of cashing a check and used deceptive tactics to prevent consumers from canceling or refunding a transaction. The CFPB also alleged that All American made deceptive statements about the benefits of high-cost payday loans and failed to provide refunds after consumers overpaid their loans.

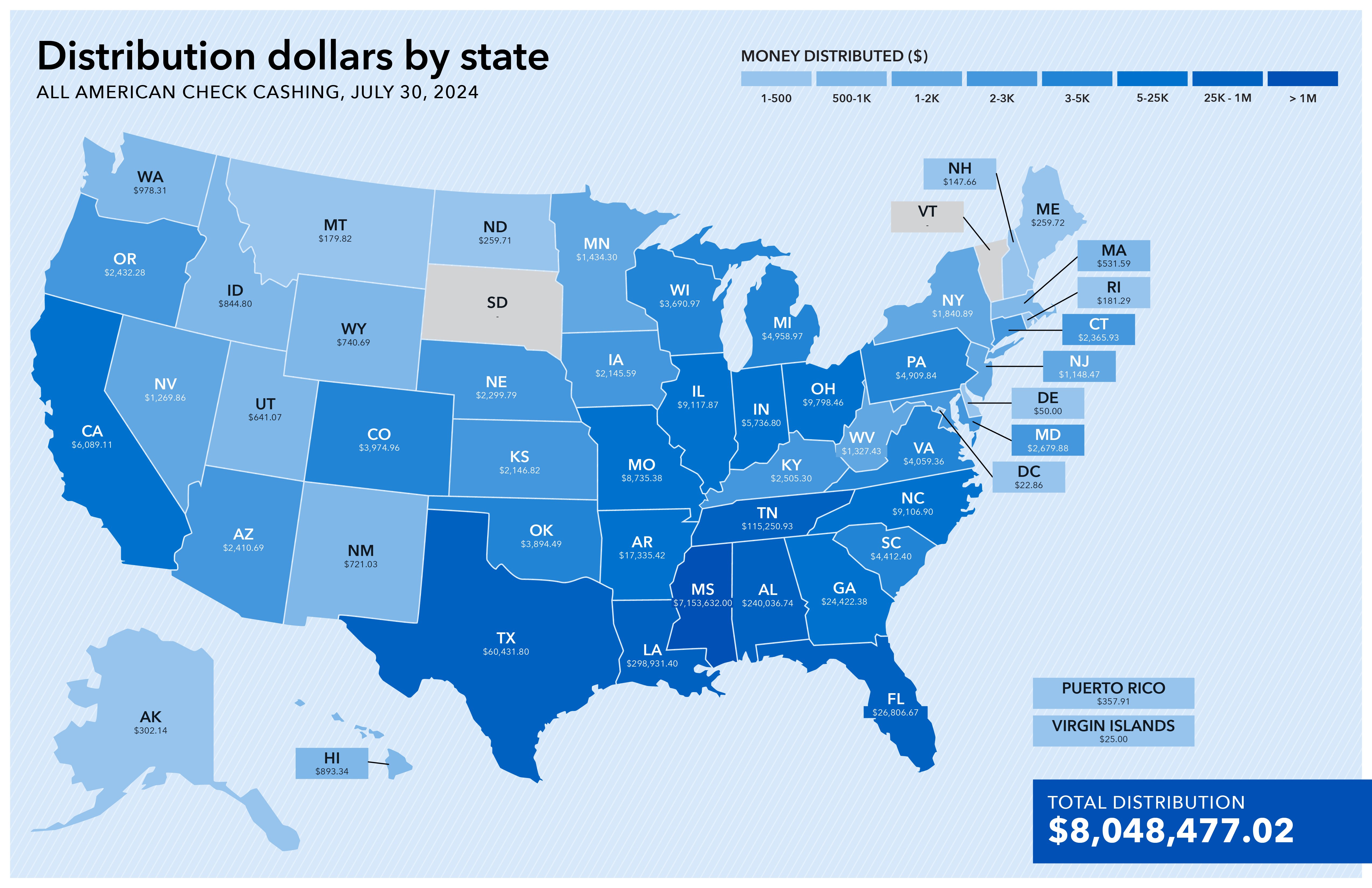

As a result of the lawsuit, the CFPB will distribute $8,048,477.02 in total payments to consumers through its Civil Penalty Fund. The payments will be mailed on July 30, 2024, through Rust Consulting.

If you have questions about receiving a refund, email AllAmerican_info@rustcfpbconsumerprotection.org or call 1-888-400-7907.

Learn more about the distribution.

Action against All American Check Cashing

Headquartered in Madison, Miss., All American Cashing Check Cashing, Inc., offered check cashing services and payday loans at approximately 50 stores in Mississippi, Alabama, and Louisiana. The CFPB alleged that All American collected more than approximately $1 million per year in check-cashing fees, which varied by state and whether the checks were government issued.

The CFPB alleged that All American explicitly forbid employees from disclosing the check-cashing fees. The CFPB alleged that the fees were hidden by employees counting the money over the receipt and removing the receipt and check as quickly as possible. When consumers asked to cancel or reverse a transaction after learning about the fee, the CFPB alleged that they were falsely told it either couldn’t be canceled or would take a long time to be reversed. In some cases, the CFPB alleged that employees also applied a stamp on the back of the check to make it difficult or impossible for it to be cashed elsewhere.

The CFPB also alleged that the company aggressively pressured consumers into multiple loan and monthly lending models targeted towards consumers receiving monthly government assistance. While many competitors offered 30-day loans, the CFPB alleged that All American would provide borrowers with three or more two-week loans where an individual would take out a loan at the beginning of the month, followed by a second loan to pay off the first, and a third to extend borrowing until the end of the month.