Fed Hikes Rates Half-Point as Powell Signals Similar Moves Ahead

Courtesy of Matthew Boesler and Steve Matthews, Bloomberg

-

Interest-rate increase marks largest upward move since 2000

-

Stocks rally as Powell pushes back on 75 basis-point Fed move

The Federal Reserve delivered the biggest interest-rate increase since 2000 and signaled it would keep hiking at that pace over the next couple of meetings, unleashing the most aggressive policy action in decades to combat soaring inflation.

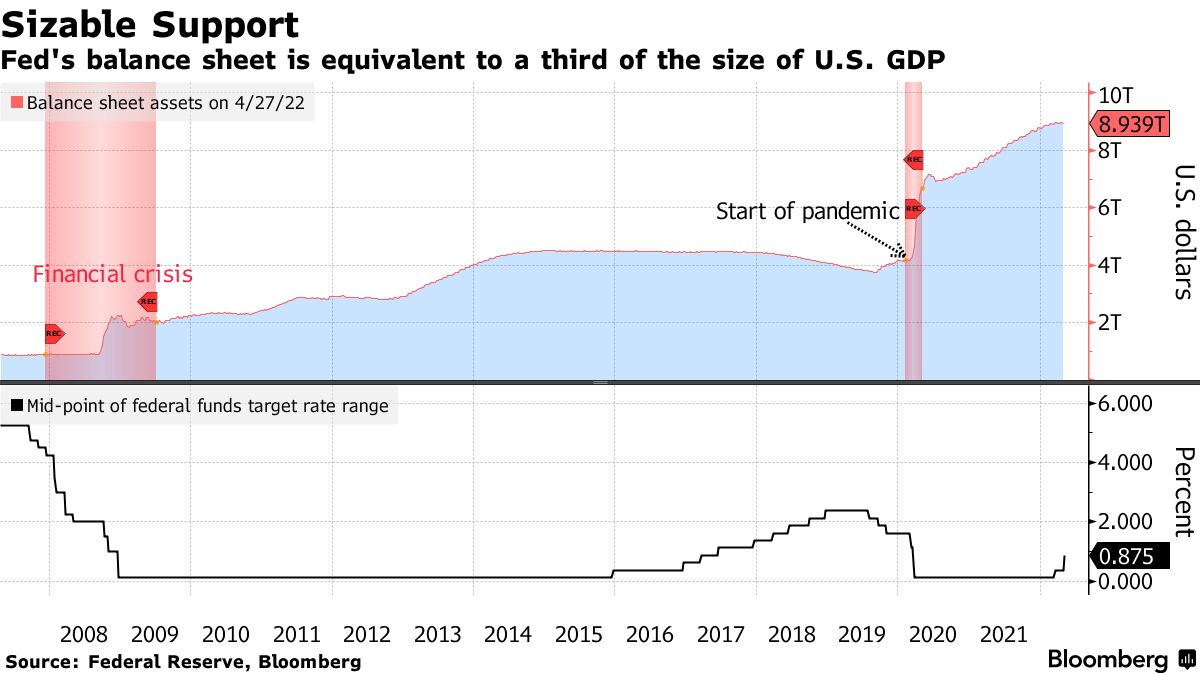

The U.S. central bank’s policy-setting Federal Open Market Committee on Wednesday voted unanimously to increase the benchmark rate by a half percentage point. It will begin allowing its holdings of Treasuries and mortgage-backed securities to decline in June at an initial combined monthly pace of $47.5 billion, stepping up over three months to $95 billion.

“Inflation is much too high and we understand the hardship it is causing and we are moving expeditiously to bring it back down,” Chair Jerome Powell said after the decision in his first in-person press conference since the pandemic began. He added that there was “a broad sense on the committee that additional 50 basis-point increases should be on the table for the next couple of meetings.”

Powell’s remarks ignited the strongest stock-market rallyon the day of a Fed meeting in a decade, as he dashed speculation that the Fed was weighing an even larger increase of 75 basis points in the months ahead, saying that it is “not something that the committee is actively considering.”