Nov. 15, 2019 NASCUS Report

Posted November 15, 2019THIS WEEK: NCUA Board looks at ‘2nd chance’ statement, appraisals; Summary outlines non-member share rule; Regulators gear up for switch from LIBOR; State-by-state ‘well-being’ report issued; Exam council updates biz booklet; ON THE ROAD: In CT discussing issues; VT podcast examines NASCUS; Exchange discusses key issues; BRIEFLY: Exempting vet biz loans from cap; summary of exec orders

Final ‘2nd chance’ policy statement,

residential RE appraisals, on agenda

NCUA will consider a final, new policy regarding statutory prohibitions of individuals from financial institution service – called the agency’s “second chance” proposal – and a proposal on residential real estate appraisals at its meeting next week in Alexandria, Va.

The agency Thursday released its agenda for the meeting of the agency’s board in one week, set for Nov. 21 at 10 a.m.

As proposed in July, the new interpretive ruling and policy statement (IRPS) would update the agency’s interpretive ruling which implements section 205(d) of the Federal Credit Union Act by reducing the scope and number of offenses that would require an individual to apply to the agency board for permission to work (and participate in the affairs) of a federally insured credit union. Those persons have typically been convicted of a criminal offense involving dishonesty or breach of trust, or who have entered into a pretrial diversion or similar program in connection with a prosecution for such offense.

According to NCUA, the proposal is especially aimed at individuals prohibited for offenses they may have committed as youths.

In its comment on the proposed IRPS last summer, NASCUS wrote that the state system generally supports the policy. “NCUA has taken a measured approach that balances mitigating risk to a federally insured credit union with providing a meaningful second chance to individuals who having committed a prior indiscretion have paid their debt to society and seek gainful employment,” NASCUS wrote in its comment letter. “NASCUS agrees that NCUA’s proposed changes will bring additional clarity to credit unions and individuals subject to the FCUA sec. 205(d) framework.”

In July, when the proposal was issued, NCUA Board Chairman Rodney Hood said he was personally committed to more initiatives such as the “second chance” proposal and said to “expect more coming from this agency to work with second-chance individuals.”

In other action, the board will propose a rule under part 722 (real estate appraisals) of its regulations to address appraisals for residential real estate-related transactions. According to the Unified Agenda of Federal Regulations (maintained by the White House Office of Management and Budget), the proposed rule would increase the threshold level below which appraisals would not be required for residential real estate-related transactions.

In October, a final rule from the agency went into effect on non-residential real estate appraisals. That rule (among other things) raised to $1 million the threshold for commercial real estate transactions subject to required appraisals from state-certified appraisers.

LINK:

Board Agenda for the November 21, 2019 Meeting

Summary outlines non-member share rule (effective Jan. 29)

NCUA’s new rule on nonmember shares – which changes the basis for measuring the regulatory limit — will take effect Jan. 29, according to a new final rule summary (members only) published by NASCUS this week.

The final rule, adopted by the NCUA Board Oct. 24, essentially gives federally insured credit unions (FICUs) more sources from which to build deposit bases (if, in the case of state-chartered credit unions, state law allows them to do so as well; the new rule serves only as a limit for federal share insurance coverage).

According to the final rule, adopted by the board unanimously, a FICU could receive “public unit” (deposits from local, state and federal governmental agencies) and nonmember shares up to 50% of the credit union’s paid-in and unimpaired capital and surplus less any public unit and nonmember shares, or $3 million – whichever is more.

In addition, the final rule eliminates the previous requirement that a FICU request a waiver from the agency’s regional office if it wants to exceed the limit. Instead, a FICU would be required to develop a specific use plan if its nonmember shares, combined with its borrowings, exceed 70% of paid-in and unimpaired capital and surplus. Examiners would also be charged with watching the level at which credit unions accepted the non-member shares (which also include the public unit shares, or funds provided by the federal government and its agencies, state governments and agencies, local public school systems, and more).

“Raising the limit for public unit and non-member deposits enhances credit union liquidity options and allows credit unions accepting these deposits to preserve other lines of credit,” NASCUS President and CEO Lucy Ito said when the rule was adopted by the board last month. “We are particularly pleased that NCUA heeded NASCUS’ call to retain the regulatory limit on public unit and non-member shares of $3 million in addition to the newly approved 50% limit of paid-in and unimpaired capital and surplus.”

LINK:

Final Rule Summary: Public Unit and Nonmember Shares (members only)

Regulators, others, gearing up for move away from LIBOR

In case you may not have heard, the reference rate “London Interbank Offered Rate” – used by some credit unions and others to set rates for such lending products as residential mortgages – is going away after 2021 and state and federal regulators – and others — are working to help credit unions get ready.

Last week, the NASCUS Legislative and Regulatory Affairs Committee discussed (during its monthly conference call) credit unions’ transition from LIBOR to alternative reference rates. Among the state agencies that have issued notices to credit unions are the Georgia Department of Banking and Finance and the North Dakota Department of Financial institutions. (See links to their notices to credit unions, below.)

Meanwhile, NCUA wants credit unions to tell them about the impact of the changeover from LIBOR on the Credit Union Profile form.

In a request for comment published today in the Federal Register, NCUA said it wants to add two questions to the Profile form – Form 4501A, used to collect non-financial data relevant to regulation and supervision – that will require only “yes” or “no” answers. “These questions are needed to identify federally insured credit unions (FICUs) that have LIBOR instruments or use LIBOR as a reference rate. Examiners will use this information to assess credit unions’ exposure, governance, risk management and readiness related to the discontinuation of the LIBOR index after 2021,” according to the NCUA notice.

NCUA will accept public comments on its proposed Profile form change for 60 days; comments would be due on or about Jan. 13.

Coincidentally, also this week (and unrelated to NCUA’s proposal), the Financial Accounting Standards Board (FASB) issued temporary guidance (expected to be finalized in early 2020) aimed at easing the process of stakeholders migrating away from LIBOR to new, replacement reference rates, such as the Secured Overnight Financing Rate (SOFR). It said the finalized guidance will address stakeholders’ operational challenges, help simplify the migration process, and reduce related costs.

LINKS:

Georgia notice on LIBOR switchover

North Dakota notice on LIBOR switchover

NCUA proposed Profile changes: LIBOR questions

First state-by-state financial ‘well-being’ report issued

First state-by-state financial ‘well-being’ report issued

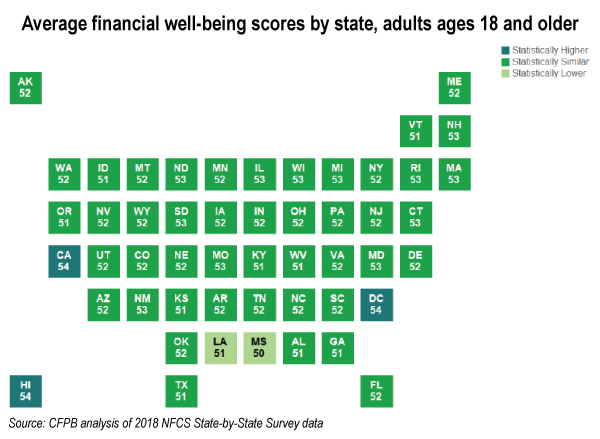

Average “financial well-being” scores among individual states ranged from 50 to 54 out of a possible 100, the CFPB said this week, with California, the District of Columbia and Hawaii scoring the highest – each with 54.

According to the bureau, the report provides the first state-by-state description of the financial well-being of adults in the United States, as measured by the CFPB Financial Well-Being Scale.

The scores are based on an analysis of findings of the Financial Industry Regulatory Authority (FINRA) Foundation’s 2018 National Financial Capability Study for adults aged 18 and older. The bureau said the scores for each state are standardized numbers between 0 and 100 that quantified a person’s underlying level of financial well-being. They are calculated by an individual’s responses to the 10 questions in the bureau’s Financial Well-Being Scale (explained in Wednesday’s report by the CFPB).

“Financial well-being is defined as the state wherein an individual has a sense of: control over day-to-day and month-to-month finances; capacity to absorb a financial shock; being on track to meet financial goals; and ability to make financial choices to enjoy life,” the bureau stated in a release.

For the United States, the average financial well-being score was 52, according to the study results. For younger and middle-age adults (ages 18 to 61) the average financial well-being score in the U.S. was 49, while the financial well-being score for older adults (ages 62 and older) was 62. The report also describes how score patterns vary by these age groups state by state.

LINK:

CFPB report: Financial Well-Being by State

Exam Council updates biz continuity management booklet

The Business Continuity Management booklet within federal financial institution regulators’ Information Technology Examination Handbook has been revised to emphasize the importance of ensuring financial institutions’ preparedness to avoid disruptions in operations and to recover services.

The revised booklet, announced Thursday by the FFIEC (which includes NCUA and NASCUS via the council’s State Liaison Committee (SLC)), focuses on enterprise-wide approaches that address technology, business operations, testing, and communication strategies critical to the continuity of the business. It describes principles and practices for information technology (IT) and operations designed to achieve safety and soundness, consumer financial protection, and compliance with applicable laws, regulations, and rules.

The Exam Council noted that the booklet “describes principles to help examiners determine whether management addresses risks related to the availability of critical financial products and services” and includes updated examination procedures to help examiners assess the adequacy of an entity’s overall business continuity management program.

The guidance is for examiners of depository institutions (credit unions, banks and thrifts), nonbank financial institutions, bank holding companies, and third-party service providers; it’s also a tool institutions may use to understand examiners’ expectations.

ON THE ROAD: In CT discussing NCUA, national issues

NCUA Board Chairman Rodney Hood (at left, third from right) joins credit union regulator and association officials during a break at the Connecticut Executive Forum this week in Rocky Hill, Conn. The day-long event, co- sponsored by NASCUS, the Connecticut Department of Banking and the Credit Union League of Connecticut, brought credit unions and regulators together to discuss key state and national issues facing the state credit union system – including cybersecurity, enterprise risk management, national issues and more. Joining Hood are (from left) Judy Britt (CU League of Conn.), Tony Conway (Connecticut Department of Banking (CT DOB)), Jorge L. Perez (Connecticut Banking Commissioner); Hood; Mary Ellen O’Neill (director, Financial Institution Division, CT DOB) and Emmerilda Zego (CU League of Conn.). At right, NASCUS Executive Vice President and General Counsel Brian Knight addresses national credit union issues affecting the state credit union system during the event.

VT podcast offers concise overview of NASCUS

Hankering to learn more about NASCUS and parts of its core mission? A new podcast produced by the Association of Vermont Credit Unions (AVCU) focuses on both, featuring former NASCUS Chairman (and former, long-time deputy commissioner of the Vermont Department of Financial Regulation) Tom Candon, and available on the association’s website.

In the 30-minute podcast – hosted by AVCU President and CEO Joe Bergeron – Candon discusses the history of NASCUS, his personal experience with NASCUS, and the importance of NASCUS in voicing the views of states with regard to legislation and regulation coming out of Washington, the dual chartering system (and its importance to the strength of credit unions across the nation), and more.

Candon is now a member of the NASCUS Accreditation Review Team, which works with state regulatory agencies to adopt and adhere to quality standards for their states’ credit union examination and supervision. Modeled on the university accreditation concept, the program applies national standards of performance to a state’s credit union regulatory program.

The accreditation process, Candon told Bergeron, helps a state to determine what changes (if any) in statute or regulation it may need when measured against standards adopted by other states to ensure strong, safe credit unions. “It’s really beneficial to the state,” Candon says in the podcast.

For the compete recording, click on the link below.

LINK:

Podcast: Former DFR Deputy Commish Candon Talks NASCUS

Exchange discusses key issues

NASCUS hosted another “Exchange” this week in Chicago among regulators, credit union leaders and NCUA Board Member Todd Harper. The group at the all-day gathering had a full list of topics to discuss, including: Subordinated debt, the “ONES” program for large credit unions (including transition to direct CFPB supervision); third-party vendor exam authority; investments authority; field of membership issues; credit union acquisition of banks; cannabis/hemp banking – and more. “Our Exchanges offer regulators and credit unions an opportunity to sit down and engage in mutual dialog about key issues affecting the state credit union system,” said NASCUS President and CEO Lucy Ito. “These are frank discussions that place the issues out on the table; at the end of the discussion, all have a better grasp of how the issues affect their institutions and agencies – which we hope leads to a better strategic positioning for all credit union system stakeholders as they collectively prepare for a rapidly changing financial services marketplace.” Participants included state regulators from Florida, Georgia, Illinois, North Carolina, Texas, and Washington as well as credit union executives from Alliant CU, BECU, Canvas CU, Colorado CU, and Vystar CU, along with Board Member Harper’s Senior Policy Counsel Catherine Galicia and NASCUS CEO Lucy Ito and Executive Vice President and General Counsel Brian Knight.

BRIEFLY: Bill would exempt veteran biz loans from cap; Summary looks at president’s Executive Orders

Legislation that would exempt loans made to veteran-owned businesses from a credit union’s member business lending cap was introduced in the Senate this week. The Veterans Member Business Loan Act (S. 2834), introduced by Sens. Dan Sullivan (R-Alaska) and Mazie Hirono (D-Hawaii) would exclude extensions of credit for businesses made to veterans from the definition of a member business loan. It has received wide support from the credit union industry … NASCUS has published a summary of two executive orders issued recently by President Donald Trump, on (respectively) E.O. 13891 Executive Order on Promoting the Rule of Law Through Improved Agency Guidance Documents; and, E.O. 13892 Executive Order on Promoting the Rule of Law Through Transparency and Fairness in Civil Administrative Enforcement and Adjudication. Both were issued Oct. 9. The summary is available to members only.

LINKS:

2834: the Veterans Member Business Loan Act

NASCUS Summary: White House Executive Orders (members only)

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.