Dec. 13, 2019 NASCUS Report

Posted December 13, 2019THIS WEEK: RBC delayed to 2020 (new capital framework coming); Ito: Capital reform should be in place now; Board gives nod to budget, higher OTR; States maintain nearly half of all assets; Summary looks at ‘2nd chance’; CFPB sees new payday rule by April; Bureau report outlines FCRA violations; ON THE ROAD: IN TN with CU leaders; TRANSITIONS: Promotion in MA; Thanks for supporting NASCUS; BRIEFLY: Court denies banker FOM appeal, Farewell to Walters, FinCEN sets up public advocacy arm

RBC delay approved in split vote;

new ‘capital framework’ ahead

A delay for the “risk-based capital” (RBC) rule to 2022 was approved by the NCUA Board Thursday, largely based on the presumption that the agency will soon be considering a “suite” of capital reform proposals for credit unions – including a form of additional capital known as “subordinated debt.”

In a 2-1 vote (with Board Member Todd Harper dissenting), the board delayed the RBC rule – previously slated to take effect at the start of next year – to 2022. As the rule stands now, it would affect only those “complex” federally insured credit unions with more than $500 million in assets. The delay approved at the board meeting was the second such for the rule since it was first adopted in 2015. In the meantime, NCUA’s prompt corrective action (PCA) requirements remain in effect between now and the time a final RBC rule – or other — is implemented.

NCUA Board Chairman Rodney Hood said the delay gives the agency time to consider new methods for strengthening credit union capital requirements, indicating that now is a good time to do so as credit unions enjoy strong capital positions. “I look forward to continuing to review the RBC rule more closely in the months to come and making additional improvements to the rule that will serve to make it more effective for credit unions and the nearly one-third of Americans that they serve,” he said.

Board Member Mark McWatters expanded on Hood’s comments, noting that the agency is now looking “at a suite of capital rules” which will include subordinated debt for non-low-income credit unions that will count as capital for risk-based net worth purposes. “Currently, that does not exist,” McWatters said. He said he had received “distinct assurances” that the proposal would come before the NCUA Board in January. “It’s a good rule, it’s a complex rule – we’ll need a lot of feedback on it,” he said.

(In the short video (click on the arrow to play), NCUA Board Member J. Mark McWatters discusses the “suite” of capital reform proposals to come before the agency board in the first two months of 2020: on subordinated debt and a credit union version of the “community bank leverage ratio” (CBLR) to exempt credit unions from provisions of risk-based capital requirements.)

He indicated the suite of capital rules will also include a proposal similar to the community bank leverage ratio (CBLR), adopted by the federal banking agencies this year, for credit unions. That rule, he indicated, would exempt credit unions with less than $10 billion in assets from complying with the risk-based capital requirements, if those credit unions meet certain requirements.

“I’ve received assurances that this rule will be brought before the board in February,” he said.

In opposing the delay, Harper said the time has long-since come for the board to implement the RBC rule. In voting to further delay the rule, Harper said, the board is “forgetting the past, just like the characters in ‘Groundhog Day,’” referring to a movie in which the lead character relives the same day over and over. He said he voted against the proposal to extend the effective date – as he would against the final rule – because “I believe credit unions should hold capital equal to the risks held on their balance sheets.”

LINK:

Final rule: Delay of Effective Date of the Risk-Based Capital Rules

Ito: Capital reform should be in place now

In the wake of the board’s decision, NASCUS President and CEO Lucy Ito urged the NCUA Board to move forward quickly on a comprehensive capital framework. “The economy is stable now and it appears it will be stable in 2020; however, that may not be the case in 2021 or 2022,” she said. “Capital reform should be in place ahead of the next economic downturn to help credit unions buffer the impact of higher unemployment, decreases in house values, and more.” She said the state system is encouraged that the NCUA Board shared its intended timeline for releasing proposals for a subordinated debt rule and a credit union version of the CBLR. She added that NASCUS is, however, disappointed that the RBC rule has been delayed for an additional two years. “Perhaps if NCUA resolves the related capital issues, it will be in a position to re-consider implementing the RBC rule prior to the current Jan. 1, 2022 effective date,” she said.

Board raises OTR; sees no insurance fund distribution for ‘20

Also at this week’s meeting, the NCUA Board:

- Approved, also on a 2-1 vote (with Harper again dissenting), a 2020 operating budget of $315.8 million, an increase, the agency said, of 3.8% from the 2019 spending plan. The budget also includes a 61.3% “overhead transfer rate” (OTR) of funds from the National Credit Union Share Insurance Fund (NCUSIF) to cover insurance-related costs of the NCUA – a slight increase from 2019’s OTR of 60.5% (and something of strong interest to the state credit union system). The budget also includes a $500,000 estimate for new state examiner laptop leases in 2021. Staff said that number is higher than the 2020 totals because most of the costs for the new computers are paid in the first year of the project.

- Harper said he voted against the overall budget because it did not include additional spending for more staff in the agency’s consumer compliance program, which he had requested. He said he was “deeply disappointed” that a negotiated agreement among NCUA board members to add two positions to the consumer compliance section of the agency was not included in the final budget. McWatters said he also supported budget increases for the consumer compliance program “in a sensible, proactive manner.” However, he said, he was voting in favor of the budget because not doing so would leave the agency without an adjusted spending plan for 2020; he said he intended to pursue a “collegial, collaborative” path forward for additional consumer protection resources at the agency.

- Heard a report on the NCUSIF, particularly the reserve level for the fund. Staff reported that, based on current estimates, the NCUSIF would have adequate reserves for 2020 (estimated at about 1.38% to total credit union insured savings). However, the staff also told the board that it did not anticipate the reserve level rising significantly enough that credit unions would receive in 2020 an “equity distribution” of excess reserves.

Regarding the OTR, NASCUS’ Ito said the state system appreciates the additional detail provided in NCUA’s budget justification on what factors contributed to the rate’s increase to 61.3% in 2020. “Going forward, NASCUS looks forward to working with NCUA to more accurately project the likely costs associated with State Supervisory Agencies,” she said.

LINKS:

NCUA 2020-21 Budget recommendation

States continue hold on 49% of all assets

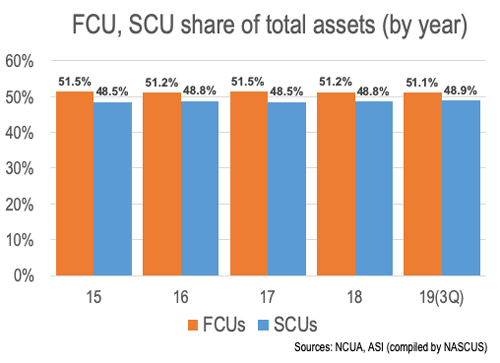

The state system held its ground in share of assets in the credit union system at the end of the third quarter, with about 49% of the total, according to figures released late last week by NCUA and compiled by NASCUS.

The third-quarter 2019 numbers released by NCUA for all federally insured credit unions (FICUs), plus the third-quarter totals reported for privately insured credit unions (PICUs) by American Share Insurance (ASI), showed state credit unions now hold total assets of about $761 billion. Assets at federal credit unions, the figures revealed, stood at $795 billion at the end of the third quarter.

Those numbers also indicate that, through the third-quarter of 2019, state credit unions are growing a bit faster in assets than federals, expanding at a rate of 6.2%; federals grew their assets by 5.5%. Overall, assets in the credit union system (state and federal) grew by 5.8% through the third quarter.

Meanwhile, the state system has added more than 1.6 million members since the end of last year, the figures show, for a total of 57.8 million. FCUs, over the same period, added 1.7 million members for a total of 63 million. The rate of growth for both state and federal was essentially the same (about 3%).

The total number of credit unions, however, continued to decline, with both state and federal credit unions seeing their numbers recede by about 2% through the third quarter. The figures show there were 2,071 credit unions in the state system and 3,321 FCUs as of Sept. 30, 2019.

At the end of the 2019 third quarter, assets for all credit unions combined were $1.55 trillion (growing by 3.21% since year-end 2018), and memberships were at just under 121 million (up about 2.9%). Total credit unions stood at 5,392, down about 2% from year-end 2018.

Summary gives outline of ‘2nd chance’ initiative

A summary of the “second-chance” initiative from NCUA – which takes effect Jan. 2 – is outlined in a new summary from NASCUS, published this week. The initiative, issued as an interpretive rule and policy statement (IRPS) by NCUA in November, removes the requirement that persons convicted of minor offenses — including those who were young adults at the time — would no longer need a waiver from the agency to obtain a job at a credit union. As adopted, the rule means that persons with convictions or program entries for offenses involving insufficient funds checks of aggregate moderate value, small dollar simple theft, false identification, simple drug possession, and isolated minor offenses committed by covered persons as young adults will not require an application for a waiver from the NCUA to serve at a credit union. The summary is available to NASCUS members only.

LINKS:

Final interpretive ruling and policy statement 19-1.

NASCUS Summary: Second Chance Interpretive Ruling and Policy Statement (IRPS) (members only)

CFPB expects final, revised payday rule by next April

A final, revised rule on payday lending is anticipated for April of next year, CFPB’s director said this week, following review of approximately 190,000 comments from stakeholders. In a speech before a gathering of the National Association of Attorneys General in Washington, CFPB Director Kathleen (“Kathy”) Kraninger said she maintains “an open mind about the final rulemaking and the Bureau’s efforts related to payday lending.”

In other remarks, the bureau director said the agency continues to consider comments received on its proposed rulemaking for debt collections. The proposal (which generated some 14,000 comment letters), she reminded the group, addresses communications in connection with third party debt collection, and interprets and applies prohibitions on harassment or abuse, false or misleading representations, and unfair practices in debt collection. She said it also clarifies requirements for certain consumer-facing debt collection disclosures.

Kraninger also noted her agency has completed testing of consumer disclosures related to time-barred debt disclosures that were not addressed in a May 2019 proposal. “We plan to release a Supplemental Notice of Proposed Rulemaking on this very early in 2020,” she said. “These disclosures are inextricably linked to state law. Reconciling these disclosures could help consumers receive the benefits of federal and state disclosures, while at the same time reducing uncertainty and compliance burdens for debt collectors.”

The CFPB director said that, once the supplemental proposal is issued, the agency “will be interested in practical and pragmatic ideas of how to make time-barred debt disclosures work.”

LINK:

Director Kraninger’s Remarks Before the National Association of Attorneys General Capital Forum

Bureau outlines violations, weaknesses under FCRA

New violations and compliance management system weaknesses under the Fair Credit Reporting Act (FCRA) and Regulation V are outlined in the 20th issue of “supervisory highlights” published by CFPB this week.

According to the bureau, the violations were committed by those which the agency calls “larger participants in the consumer reporting market” as well as furnishers of consumer information – including “banks, mortgage servicers, auto loan servicers, student loan servicers, and debt collectors” to consumer reporting companies (CRCs)

Among the violations reported are:

- Some exams of debt collector organizations providing information found that the policies and procedures of the organizations did not differentiate between FCRA disputes, Fair Debt Collection Procedures Act (FDCPA) disputes, or validation requests.

- In some exams of auto loan information furnishers, the agency found policies and procedures did not provide sufficient guidance for conducting reasonable investigations of indirect disputes that contain allegations of identity theft.

- Examiners found that some mortgage information furnishers’ policies and procedures were not appropriate to the nature, size, complexity, and scope of the furnisher’s activities.

- Some furnishers of deposit account information, the report states, had no written policies or procedures for furnishing that information to specialty CRCs.

In addition, regarding deposit account information, the agency said its exams found that some organizations did not have reasonable written policies and procedures regarding the information. The bureau stated that some furnishers of the deposit account information are now “evaluating the effectiveness of existing policies and procedures regarding the accuracy and integrity of information furnished to nationwide specialty CRCs and develop new written policies where appropriate.”

LINK:

Supervisory Highlights Consumer Reporting Special Edition

ON THE ROAD: In TN with credit union leaders

NASCUS CEO Lucy Ito was in Tennessee this week meeting with and presenting to members of the Tennessee Credit Union League for the Top 25 Credit Union Forum. At the meeting, Ito delivered a presentation outlining the current state of the dual charter system and an extensive overview of the latest developments at NCUA. The TCUL, led by President and CEO Fred Robinson, is a key NASCUS partner and stakeholder with Tennessee credit unions, proportionally representing the highest number of state credit union memberships in NASCUS. Jeff Dahlstrom, President of Southeast Financial Credit Union in Nashville, serves as a director on the NASCUS Credit Union Advisory Council.

TRANSITIONS: More promotions in MA

Irene Weydt is now the chief director of depository institution consumer protection examinations for the Massachusetts Division of Banks, where she will oversee consumer protection compliance examinations relative to Massachusetts-chartered credit unions and banks. Her most recent position at the agency was chief director; she joined the department in 2008. Prior to that, she worked for a national bank. Chris Cook, who has been named chief director of risk management examinations for the DoB (and has been with the DoB since 2012), was most recently a supervisory bank examiner where he served as examiner-in-charge at large and complex institutions. Before joining the agency, he worked at a Massachusetts-chartered bank.

Thanks for your support in 2019!

NASCUS members should be in receipt of their 2020 membership renewal packets in an email sent Thursday (from [email protected]); please check your inbox (including spam or other such folders) to ensure you received your invoice. Above all, to all recipients: thanks to all for your membership in 2019! NASCUS appreciates the support you offer to our association, as we advocate for a safe and sound state credit union system and for a strong and healthy dual-charter system. Questions or comments? Contact NASCUS VP of Member Relations Alicia Erb.

BRIEFLY: Court denies banker appeal over FOM rules, farewell to NCUA’s Walters, top federal BSA/AML enforcement agency gets public outreach arm

A federal court has turned down an appeal by the banking industry in its attempt to overturn NCUA field of membership rules upheld by a lower court this summer. The U.S. Court of Appeals for the D.C. Circuit Thursday denied the American Bankers Association’s appeal for a rehearing en banc in its lawsuit against NCUA’s field of membership rule … Thanks and best wishes from the state system to NCUA Easter Region Director Jane Walters, who is retiring from the agency Jan. 3, as acknowledged at the NCUA Board meeting by all three board members … “Strategic Ops” is the nickname for a realigned division of the Treasury’s Financial Crimes Enforcement Network (FinCEN) that will foster the law enforcement agency’s ties with the public – including local and state governments and the federal government. Treasury said the division (officially known as the “Strategic Operations Division”) will “help direct FinCEN’s operational information sharing and engagement with domestic and international stakeholders, as well as assist in implementing FinCEN’s priorities.” FinCEN said the new division will be made up of three offices: the Operational Information and Development, Stakeholder Integration and Engagement, and the Global Threat Engagement Center. A new “Cyber and Emergent Issues Section,” focused on functional and cross-cutting programming, will be created under the Global Threat Engagement Center, the agency said.

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.