Two key recommendations made in NCUA budget hearing

Dec. 4, 2020) NCUA should reconsider how it allocates expenses to the federal insurance fund for credit unions to pay for agency operations, in order to safeguard balance, equity – and ensure that more funds are available to cover any losses that may occur due to the financial impact of the coronavirus crisis, NASCUS told the agency this week.

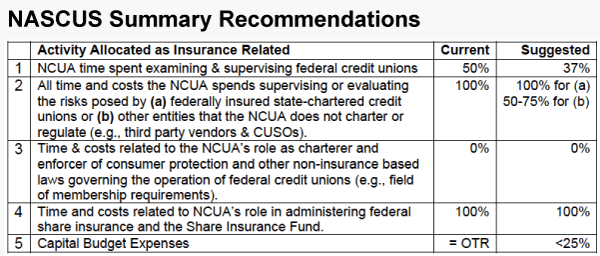

In a presentation before the NCUA Board, NASCUS’ Lucy Ito made two key recommendations for expense allocations made by NCUA to cover its “insurance related costs” paid for by the National Credit Union Share Insurance Fund (NCUSIF) through transfers to the agency’s operating budget. The transfers are made via the overhead transfer rate (OTR), which NCUA is proposing be 1 percentage point higher in 2021 from this year, or 62.3%. The OTR represents the rate at which NCUA transfers money from the insurance fund to its operating budget to cover insurance-related costs.

The two key recommendations Ito made were: reduce the amount of the funds transferred to cover costs for examining federal credit unions (FCUs) from 50% to 37% of those costs, and reduce the amount of funds transferred to cover costs of evaluating risks of entities that NCUA does not charter or regulate (such as third-party vendors and CUSOs) from 100% to a range of between 50% and 75%.

Ito, providing the state system’s view of the agency budget, focused in her remarks exclusively on the OTR and costs that are allocated to it by the agency. She was one of three to make presentations to the NCUA Board members attending the meeting, Chairman Rodney Hood and Member Todd Harper. The others making presentations represented the Credit Union Natl. Assn. (CUNA) and Natl. Assn. of Federally Insured Credit Unions (NAFCU).

In recommending changes to the expense allocations, Ito said every dollar the agency transfers from the fund to cover expenses of the agency in “insurance-related costs” is a dollar that is not available to pay for credit union losses that are likely to arise as a result of the financial impact of the pandemic.

“The 1% increase in the OTR for 2021 means there will be $3.3 million less to cover losses by the fund,” Ito said.

In other comments, Ito recommended the agency reconsider how it allocates expenses paid by the fund for capital budget costs of its operations. For example, Ito said, given increasing state agency assumption of computer and other capital costs, “it would seem that the insurance fund would carry a much smaller percentage of NCUA’s computer software and other capital charges than the agency allocates to its role as the FCU chartering authority.”

She also suggested that the agency work with state supervisory authorities to validate their time allocation assumptions that make up portions of the OTR calculations. “We noted in last year’s budget briefing we would very much welcome the opportunity to sit with NCUA and understand out how NCUA reconciles the budgetary OTR with actual time allocations,” she said, adding that the invitation remains open from the association.

LINK:

NASCUS presentation, NCUA 2021 budget briefing (Dec. 2, 2020)