CFPB Focuses on “Junk Fees” and a Slew of Issues in a Single Week

Junk Fee Initiative

October 28, 2022:

CFPB Focuses on “Junk Fees” and a Slew of Issues in a Single Week

Earlier this week, the Consumer Financial Protection Bureau’s Rohit Chopra delivered a speech to the FDIC Board of Directors at the FDIC Advisory Committee on Economic Inclusion Meeting. During that presentation, Chopra commented:

Earlier this week, the Consumer Financial Protection Bureau’s Rohit Chopra delivered a speech to the FDIC Board of Directors at the FDIC Advisory Committee on Economic Inclusion Meeting. During that presentation, Chopra commented:

“CFPB will launch the first step of the rulemaking process on Personal Financial Data Rights, pursuant to a dormant authority under Section 1033 of the Consumer Financial Protection Act. The CFPB is developing proposals to require financial institutions offering deposit accounts, credit cards, digital wallets, prepaid cards, and other transaction accounts to set up secure methods, like APIs, for data sharing. By allowing individuals to share their personal financial data in a secure way, we can facilitate more switching, lower fees, and higher levels of customer care. In many respects, this will help us move toward more traditional, cash-flow underwriting and away from black-box models that use mysterious correlations and that invite concerns about bias. It can also reduce reliance on credit scores.”

Activities over the past week have more than emphasized the agency’s drive, including the following announcements,

- CFPB Kicks Off Personal Financial Data Rights Rulemaking

Proposals under consideration would fuel market competition and strengthen consumer data rights. CFPB outlined options to strengthen consumers’ access to, and control over, their financial data as a first step before issuing a proposed data rights rule that would implement section 1033 of the Dodd-Frank Act. Under the options the CFPB is considering, consumers would be able to more easily and safely walk away from companies offering bad products and poor service and move towards companies competing for their business with alternate or innovative products and services. - CFPB Takes Action to Address Junk Data in Credit Reports

CFPB) issued guidance to consumer reporting companies about their obligation to screen for and eliminate obviously false “junk data” from consumers’ credit reports. Companies need to take steps to reliably detect and remove inconsistent or impossible information from consumers’ credit profiles. For example, many children in foster care have large amounts of information on their credit reports that is clearly junk data because as minors they are prohibited from entering into most contracts for credit.

Focusing on Guidance to Help Banks Avoid Charging Illegal Junk Fees on Deposit Accounts

Focusing on Guidance to Help Banks Avoid Charging Illegal Junk Fees on Deposit Accounts

Oct. 26, 2022 — The Consumer Financial Protection Bureau (CFPB) issued guidance about two junk fee practices that are likely unfair and unlawful under existing law. The first, surprise overdraft fees, includes overdraft fees charged when consumers had enough money in their account to cover a debit charge at the time the bank authorizes it. The second is the practice of indiscriminately charging depositor fees to every person who deposits a check that bounces. The penalty is an unexpected shock to depositors who thought they were increasing their funds.

“Americans are willing to pay for legitimate services at a competitive price, but are frustrated when they are hit with junk fees for unexpected or unwanted services that have no value to them,” said CFPB Director Rohit Chopra. “We are providing guidance on existing law that will help law-abiding businesses seeking to fairly compete and the families they serve.”

Overdraft and depositor fees likely violate the Consumer Financial Protection Act prohibition on unfair practices when consumers cannot reasonably avoid them. Today’s Consumer Financial Protection Circular on surprise overdraft fees and the CFPB’s compliance bulletin on surprise depositor fees lay out when a financial institution’s back-end penalties likely break the law.

Surprise Depositor Fees

When a consumer deposits a check that bounces, banks sometimes charge a fee to the depositor, usually in the range of $10 to $19. However, a person trying to deposit a check has no idea or control over whether the check will clear, and sometimes, that person is the victim of check fraud. In fact, there are many reasons deposited checks can bounce, and the most common reason is that the check originator does not have enough money available in their account. Charging a fee to the depositor penalizes the person who could not anticipate the check would bounce, while doing nothing to deter the originator from writing bad checks.

The bulletin explains that indiscriminately charging these depositor fees, regardless of circumstances, likely violates the Consumer Financial Protection Act. Financial institutions can generally stay on the right side of the law when they employ more tailored fee policies that charge depositor fees only in situations where a depositor could have avoided the fee, such as when a depositor repeatedly deposits bad checks from the same originator.

Surprise Overdraft Fees

An overdraft fee can become a surprise fee when the customer doesn’t reasonably expect their actions to incur an overdraft fee. For instance, even if a person closely monitors their account balances and carefully manages their spending to avoid overdraft fees, they can easily incur penalties when financial institutions employ processes that are unintelligible or manipulative.

Today’s Consumer Financial Protection Circular explains that when financial institutions charge surprise overdraft fees, sometimes as much as $36, they may be breaking the law. The circular provides some examples of potentially unlawful surprise overdraft fees, including charging penalties on purchases made with a positive balance. These overdraft fees occur when a bank displays that a customer has sufficient available funds to complete a debit card purchase at the time of the transaction, but the consumer is later charged an overdraft fee. Often, the financial institution relies on complex back-office practices to justify charging the fee. For instance, after the bank allows one debit card transaction when there is sufficient money in the account, it nonetheless charges a fee on that transaction later because of intervening transactions.

Related Reading:

- Consumer Financial Protection Circular, Surprise Overdraft Fee assessment practices

- CFPB Compliance Bulletin

- CFPB’s recent enforcement action against Regions Bank for charging surprise overdraft fees

- Learn about the CFPB’s work on junk fees at consumerfinance.gov/JunkFees.

In September 2022, the CFPB took action against Regions Bank for charging surprise overdraft fees known as authorized positive fees. As early as 2015 the CFPB, as well as other federal regulators, including the Federal Reserve, began cautioning financial institutions against charging certain types of authorized positive fees, such as the ones used by Regions to unlawfully penalize customers. Regions is required to, among other consequences, reimburse consumers all the funds it unlawfully charged since August 2018 and pay a $50 million penalty.

Today’s Consumer Financial Protection Circular on surprise overdraft fees and its bulletin on surprise deposited item fees are just the latest announcements as part of the CFPB’s junk fee initiative, one of many efforts across the federal government to increase competition and reduce unnecessary financial burdens on American families.

Junk Fee Initiative

In January 2022, the CFPB launched an initiative to scrutinize back-end junk fees that cost Americans billions of dollars. Tens of thousands of people responded to a CFPB Request for Information with their stories and complaints about unnecessary fees in banking. Since then, the CFPB has taken action to constrain “pay-to-pay” fees, and has announced a rulemaking proceeding on credit card late fees. In the last year, the CFPB has also published several research reports on overdraft fees and an analysis of college banking products.

The CFPB has observed that financial institutions have started to compete more when it comes to fees. Earlier this year multiple banks announced they were eliminating overdraft fees or updating their policies to be more consumer friendly. And, in recent months, multiple large banks announced that they are eliminating non-sufficient fund fees on their checking accounts. The CFPB estimates that these changes mean $3 billion in savings for consumers.

October 20, 2022:

The Future of Default Servicing

As fears of a recession grow, it would be prudent for everyone—servicers and regulators alike—to think hard about default servicing improvements and reforms.

Courtesy of Jonathan R. Kolodziej, DS News

Oct. 2022 — More than two years after the COVID-19 pandemic took hold of the country, mortgage servicers may finally be in a position to come up for air and reflect on the whirlwind of the recent past. Among other things, the servicing industry has had to navigate the quick enactment of the CARES Act forbearance program, a constant barrage of agency and government-sponsored entity (GSE) guideline announcements and developments, a patchwork of state mandates, last-minute changes to the federal servicing rules in Regulation X, and intense public scrutiny from the Consumer Financial Protection Bureau (CFPB). To date, servicers have collectively provided assistance to many millions of mortgage loan borrowers who were impacted by the pandemic. While there is certainly still more work to be done, servicers’ willingness to help consumers and the overall effort put forth by the servicing industry at large has been admirable and commendable.

Oct. 2022 — More than two years after the COVID-19 pandemic took hold of the country, mortgage servicers may finally be in a position to come up for air and reflect on the whirlwind of the recent past. Among other things, the servicing industry has had to navigate the quick enactment of the CARES Act forbearance program, a constant barrage of agency and government-sponsored entity (GSE) guideline announcements and developments, a patchwork of state mandates, last-minute changes to the federal servicing rules in Regulation X, and intense public scrutiny from the Consumer Financial Protection Bureau (CFPB). To date, servicers have collectively provided assistance to many millions of mortgage loan borrowers who were impacted by the pandemic. While there is certainly still more work to be done, servicers’ willingness to help consumers and the overall effort put forth by the servicing industry at large has been admirable and commendable.

As the frequency and magnitude of COVID-related developments continues to slow down, now is a good time to reflect on the past couple of years and begin to plan for the future. What has worked well and could be incorporated into our standard servicing practices moving forward, and what lessons could be learned from mistakes that were made to improve the landscape for mortgage loan borrowers and their servicers in the future? Especially as fears of a recession grow, it would be prudent for everyone—servicers and regulators alike—to think hard about default servicing improvements and reforms.

Many industry groups and other interested parties have already been contemplating new forward-thinking policy ideas, such as putting more reliance on forbearance as a go-to option for consumers who are in the early stages of a financial hardship. However, there are also many legislative and regulatory reforms that should be considered as we move into a post-COVID world. This article outlines a few such ideas.

WHERE WE’VE BEEN

WHERE WE’VE BEEN

Coming out of the financial crisis of the late 2000s, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 created the CFPB and instructed the new agency to implement reforms in the mortgage servicing industry. In 2013, the CFPB released its final mortgage servicing rules, and they became effective in January 2014. The new rules covered three main areas related to default servicing: (1) early intervention, which established an early and ongoing communication framework for borrowers who become delinquent; (2) continuity of contact, which attempts to ensure that servicers have dedicated personnel that are knowledgeable and able to assist delinquent borrowers; and (3) loss mitigation, which establishes a procedural framework for working with borrowers to find alternatives to foreclosure, as well as dual-tracking restrictions to ensure foreclosure and loss mitigation are not moving forward simultaneously.

In 2016, the CFPB released a substantial set of amendments to the original servicing rules, and a fair number of the changes were in the loss mitigation area. Since that time, the only movement has related to COVID. In June of 2020, the CFPB recognized the need to relax the existing loss mitigation restrictions to facilitate servicers’ ability to quickly and efficiently offer a deferral option to COVID-impacted borrowers. Finally, in July 2021, the CFPB released a COVID final rule that related exclusively to default servicing requirements in Regulation X. Among other things, the 2021 final rule imposed more prescriptive content requirements for many live contacts that are established with delinquent borrowers to ensure COVID options are discussed, it further loosened the loss mitigation restrictions to allow servicers to offer some streamlined loan modification options to borrowers that may have been impacted by COVID, and it instituted a strict prohibition on the filing of new foreclosure actions for the last few months of 2021, with only very limited exceptions.

WHERE WE’RE GOING

As we consider what the future of mortgage servicing should look like, we ought to acknowledge that, while there are many items that we might want to include on a theoretical wish list to improve servicers’ day-to-day lives, the practical reality is that any change in policy or in the regulatory environment must benefit consumers in a clearly articulable way. To have any meaningful chance of convincing the appropriate parties to make the recommended change, a proposal must not provide the industry with all the benefits, even if it is neutral for consumers; there must be some wins on the consumer side of the ledger.

With that in mind, one of the most obvious lessons that many learned from the pandemic was that streamlined loss mitigation options are a good thing and can be utilized to benefit servicers and borrowers alike. In early 2020, we saw that the CARES Act established a quick and efficient process for COVID-impacted borrowers to get immediate relief on their mortgage payments. The law created an extremely low bar for borrowers of federally backed mortgage loans to obtain up to 360 days of forbearance on their payments. Rather than having to submit mountains of documentation to demonstrate a possible hardship or evidence the borrower’s financial position, Congress mandated that servicers offer forbearance whenever it was requested provided that the borrower also attested to experiencing a COVID-related hardship. This could happen verbally, in writing, or even through a web portal or other online interface, making it extremely easy for borrowers to enter a forbearance program. Likewise, it also eliminated the need for servicers to expend the time and resources to work through a prolonged document chase process where they constantly try to obtain missing documentation that is needed to complete an application and for their review.

Shortly thereafter, the CFPB released its interim final rule to remove existing barriers in Regulation X that could have prevented servicers from quickly offering deferral options to COVID-impacted borrowers who were ready to resume making their regular monthly payment. A particular provision of Regulation X, which we commonly refer to as the “anti-evasion clause,” generally prohibits servicers from evaluating information received from a borrower and using it to offer loss mitigation options, unless and until the servicer collects a complete loss mitigation application from the borrower first. There are very limited exceptions to the anti-evasion clause including, for example, a carve-out for short-term forbearance plans, which allowed for the CARES Act framework to work seamlessly. Recognizing that its own rules were about to get in the way of helping millions of impacted mortgage loan borrowers, the CFPB issued an interim final rule to add COVID deferral options to the limited list of anti-evasion clause exceptions. Once again, this immensely benefited both consumers and servicers.

Finally, along the same lines as the 2020 interim final rule, the CFPB’s 2021 COVID final rule once again added a new exception to the anti-evasion clause in Regulation X, this time for certain streamlined modification options. At that time, the CFPB realized that the law accounted for, and allowed, forbearance and deferral options, but did not necessarily include a good way for servicers to quickly and efficiently evaluate borrowers who may need additional payment relief for a modification of the underlying loan. The result was another new exception to the anti-evasion clause, this time eliminating the barriers that otherwise would have stood in the way of quickly offering loan modification options to borrowers impacted by COVID–19, provided certain criteria are satisfied.

Click here to read and/or download the entire article.

October 14, 2022

Why The Crypto Economy Needs Stricter Anti-Fraud Protocols and Other Regulations

Related Reading:

-

- FSB Proposes Framework for the International Regulation of Crypto-Asset Activities Including Stablecoin Arrangements

- Regulation, Supervision and Oversight of Crypto-Asset Activities and Markets: Consultative Report

- Cryptos on the Rise 2022: A Complex Regulatory Future Emerges

- White House Urges Regulators to ‘Redouble’ Crypto Oversight Efforts

Courtesy of Tad Simons, Thomson Reuters Institute

Oct. 11, 2022 — The use of digital or cryptocurrencies as a means of exchange has grown so large, so fast that both crypto-based businesses and mainstream financial institutions have reached a regulatory tipping point

Oct. 11, 2022 — The use of digital or cryptocurrencies as a means of exchange has grown so large, so fast that both crypto-based businesses and mainstream financial institutions have reached a regulatory tipping point

In order to assert their legitimacy and expand their market reach, cryptocurrency exchanges and crypto-based business platforms need access to mainstream financial institutions. In order for traditional banks and other institutions to feel comfortable doing business with crypto-based entities, those entities need to follow the same compliance rules as other financial institutions and businesses. At the very least, that means adhering to the same anti-money laundering (AML) protocols and customer due diligence (CDD) or know-your-customer (KYC) requirements as any other business.

Transparency and trust are the issues, and in the eyes of many detractors, the current digital-currency infrastructure doesn’t have enough of either.

The pros & cons of regulating crypto

Until recently, however, the whole idea of regulating the crypto market was considered antithetical to the ethos of anonymity and decentralization that made digital currencies so attractive in the first place. When Bitcoin was created in 2009, the whole point was to create a medium of exchange that operated outside the mainstream economic ecosystem of big banks and corporations.

Now, however, large factions in both the crypto industry and the mainstream financial community see stricter government regulation as necessary and beneficial. A better public-policy framework is the best way to create an economic infrastructure in which both digital currencies and traditional fiat currencies can co-exist, the argument goes. And this will help create the foundation of trust necessary for the cryptocurrency industry’s long-term viability.

However, the main part of the problem is that although most major crypto exchanges now require customers to provide at least some basic personal information (name, address, date of birth), many still do not. Further, most do not go to the trouble of establishing proof of life, such as by cross-comparing personal data with government databases and other publicly available information, or even establishing a risk score. There also isn’t an established method (or ethos) for sharing crypto customer information with authorities or law enforcement.

The other part of the problem? Like the casino industry in the 1990s, the crypto industry needs to rinse itself of the stink of crime. Crypto’s anonymity — once its biggest selling point — is now its greatest liability. Indeed, the ability to exchange money anonymously is precisely why cryptocurrencies are so popular with drug dealers, human traffickers, arms dealers, terrorists, money launderers, and other criminals. When ransomware hackers hold a business hostage, for example, there’s a reason they want to be paid in crypto.

Crypto-based criminal activity is also making it difficult for genuine crypto platforms to establish the legitimacy and trust that they desperately need in order to expand. Indeed, so many people dabbling in digital currencies have been scammed out of so much money recently that traditional financial institutions are understandably wary. According to the Federal Trade Commission, 46,000 people lost more than $1 billion to crypto scams between Q1 2021 and Q1 2022, and currently, crypto scams account for 40% of all dollars reported lost to fraud on social media.

Those in the pro-regulation camp argue that implementing more robust procedures for customer identity verification — such as CDD and KYC processes and AML requirements — would go a long way toward deterring the criminal element. This would also help establish the credibility and stability necessary for the crypto industry’s long-term viability.

Mainstream financial institutions want these same safeguards not only to mitigate risk and comply with the AML requirements listed in the existing Bank Secrecy Act (BSA), but to create a safe on-ramp to a potentially huge new market.

How regulators are cracking down

Moving from why the crypto industry needs more regulation to how it is to be done is the challenge lawmakers and financial regulators are grappling with at the moment.

There are many different types of so-called “virtual asset service providers,” after all, and new ones are being invented all the time. Beyond well-known cryptocurrency exchanges such as Binance, Kraken, and Coinbase, which is where most people purchase or trade digital assets; there are also stablecoin issuers, marketplaces for non-fungible tokens (NFTs), and decentralized finance (DeFi) protocols, the latter of which uses blockchain technology to create self-executing “smart contracts” that require no human intervention at all.

Setting up regulatory guardrails to keep up with the proliferation and popularity of all these digital assets has become a global challenge. At the moment, the United States is behind the European Union, United Kingdom, and some other countries in terms of enacting legislation to regulate digital assets, but the Biden administration is trying its best to catch up.

Currently, in the United States, cryptocurrency exchanges (though not other forms of digital assets) are supposed to be regulated under the BSA, but the law has yet to be amended to specifically apply to digital asset service providers, so enforcement has been spotty.

The new US framework

To fix that, the Biden White House recently released a framework for US crypto regulation based on six months of research and input from all relevant agencies and stakeholders, including the US Treasury, the Securities and Exchange Commission, and the Federal Reserve.

Dubbed the First-ever Comprehensive Framework for Responsible Development of Digital Assets, the document outlines a variety of policy recommendations that are meant to represent a “whole of government” approach to the regulation of all digital assets, including stablecoins and NFTs.

The framework addresses a wide variety of issues regarding consumer protections, national security concerns, environmental sustainability (mining cryptocurrencies requires a lot of electricity), and law enforcement. It also proposes avenues for international cooperation through such organizations as the Organization for Economic Co-Operation and Development and the Financial Stability Board. The framework even contains suggestions for how the Federal Reserve might release its own government-backed digital dollar, which Fed Chair Jerome Powell has said could eliminate the need for cryptocurrencies altogether, bringing the whole argument about digital assets full circle.

Nothing in the framework has been enacted into law yet, but it’s only a matter of time. Stricter regulation of the cryptocurrency market may be tearing away the cloak of anonymity that criminals and true believers cherish so much, but if the goal is to make all digital assets safer and more useful for everyone else then the cloak must be removed.

October 7, 2022

What Passes for ‘Big’ Is Getting Bigger: A Closer Look at CU Asset Size

Related Reading:

- Connexus Follows Other Credit Unions Over the $5 Billion Asset Mark

- The Two Main Drivers of Credit Union Asset Growth: High Interest Rates on Deposits And Marketing Expenses

- Largest CU-Bank Acquisition in Wisconsin History Is Complete: Meanwhile, Arizona Financial CU finalizes its acquisition of Horizon Community Bank

- From the Fed: The New Landscape for Banking Competition

Courtesy of Jim DuPlessis, Credit Union Times

The large credit unions keep getting larger faster, making the definition of “large” an ever-moving target.

The NCUA has asset classes that are artifacts of statutes from the late 20th century, starting with an asset class of less than $10 million and moving up to the largest class of $500 million or more. As of June 30, credit unions with assets of less than $500 million accounted for 16% of the credit union movement’s assets.

Recently it has begun reporting results that use a $1 billion asset threshold for its largest group.

In early 2020, CU Times started using new thresholds based on the recognition that size is relative, and the relations change with time.

Three groups were devised with the intent that each have roughly the same assets in aggregate. But the thresholds were picked to be round, easily remembered numbers. The number of classes was three and named to conform to U.S. size standards for ordering soft drinks at a drive-thru: Small, medium and large.

Here was the breakdown as of Dec. 31, 2019:

- Small (less than $1 billion in assets) had collectively $510 billion in assets (32% the movement’s $1.58 trillion in assets as of December 2019) and 46.8 million members.

- Medium ($1 billion to less than $4 billion) had $517.3 billion in assets (33%) and 38.1 million members.

- Large ($4 billion or more) had $557.5 billion in assets (35%) and 36.8 million members.

Those thresholds were designed based on assets as of June 30, 2019, when the distribution was closer to 33% each. So credit unions that had $1 billion or less in assets were 34% of the movement’s total assets as of June 30, 2019, but that asset class had fallen to just 26% of total assets by June 30, 2022.

With the third quarter ending Friday, it seemed like as good a time as any to roll out new thresholds:

- Small (Less than $2 billion): These 4,727 credit unions had $827 billion in assets (38% of the total $2.16 trillion) and 56.8 million members as of June 30. This group’s assets have grown 20% since June 2020.

- Medium ($2 billion to less than $7 billion): These 188 credit unions had $637.8 billion in assets (30%) and 36.7 million members. Their assets have grown 24% in the past two years.

- Large ($7 billion or more): These 41 credit unions had $693.8 billion in assets (32%) and 40.3 million members. Their assets have grown 25% in the past two years.

The “small” asset class is now outsized, but past trends showed it is likely to shrink back towards 33%, while the big will get bigger.

As with past size definitions, earnings improve with size — whether using traditional annualized earnings as a percent of average assets (ROA), or operating ROA, which excludes the volatile, managed number of provisions for loan losses and instead substitutes it with net charge-offs.

Total credit unions’ ROA in the second quarter was 0.84%, down 32 bps from a year earlier, while operating ROA was 0.84%, down 17 bps. By size groups, earnings were:

- Small credit unions’ ROA in the second quarter was 0.68%, down 16 basis points from a year earlier, while operating ROA was 0.69%, down 9 bps.

- Medium credit unions’ ROA for medium-sized credit unions was 0.85%, down 35 bps from a year earlier, while operating ROA was 0.84%, down 28 bps.

- Large credit unions’ ROA in the second quarter was 1.03%, down 51 bps from a year earlier, while operating ROA was 1.03%, down 16 bps.

September 30, 2022

Expanding Crypto Lender Nexo Secures U.S. Banking Charter

A day after being sued by eight state attorneys general who claim it violated securities laws, crypto lender Nexo unveiled that it has purchased a stake in federally regulated Summit National Bank.

In buying a minority stake in the holding company that owns Summit National Bank, which is regulated by the Office of the Comptroller of the Currency, Nexo has substantially expanded the scope of products it can offer, notably bank accounts.

Other services include asset-backed loans, card programs, and escrow and custodial solutions through Summit National Bank, Nexo said in a release.

Related reading:

- U.S. State Regulators Charge Nexo Group For Not Registering Product

- Crypto Lender Nexo Stops Interest on New Deposits

- Getting Crypto Payments Compliance Right Requires Deep Experience

- Group of 9 Banks Pitches USDF Token as Stablecoin Alternative for Businesses

The deal will give its customers “access to some of the most innovative products at the intersection of traditional finance and blockchain technology,” said Kalin Metodiev, co-founder and managing partner of Nexo. He also joined the bank’s board. He also called it a major step “in Nexo’s relentless drive to better serve our U.S. customers in compliance with the constantly evolving regulatory landscape.”

Summit National Bank President and Chairman Forrest Gilman said the deal and addition of Metodiev to the board “strengthens our work on the transformation of the bank into a fully fledged cutting-edge FinTech bank with access to new clients.”

In addition the Summit partnership, Nexo plans to expand “its global commercial banking capabilities … by securing additional banking licenses on a global scale. It has more than 50 licenses and registrations globally, as well as an institutional custody solution and professional crypto trading platform.

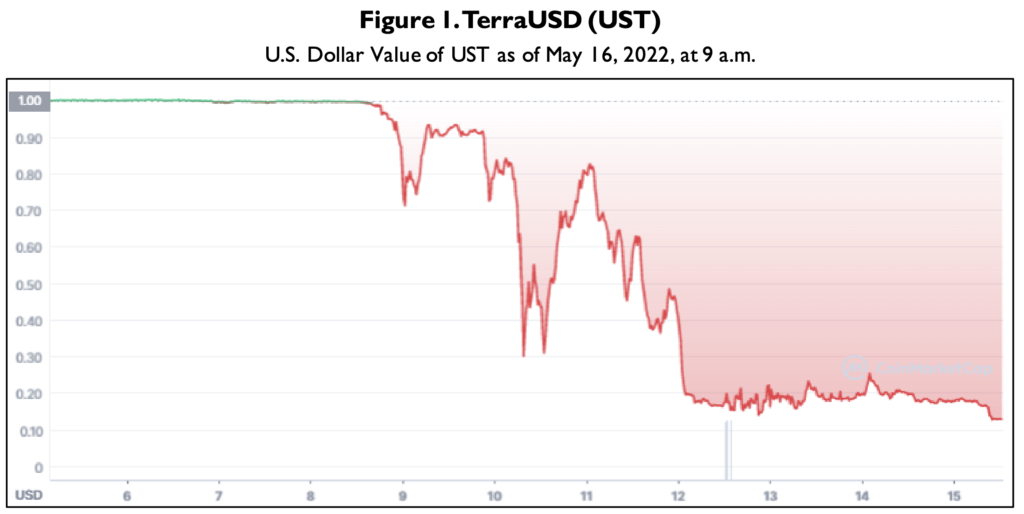

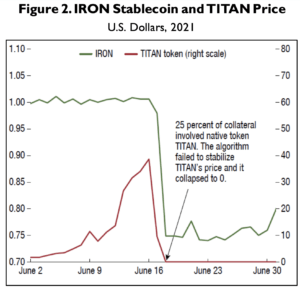

Riding the Storm Out

Nexo has been pursuing an aggressive acquisition strategy after a series of bankruptcies by crypto lenders including Voyager Digital and Celsius spurred by the $48 billion collapse in May of a stablecoin, TerraUSD. That sent a major crypto hedge fund many crypto lenders had loaned heavily to, Three Arrows Capital, into insolvency, causing a domino effect.

In June, Nexo, which is based in Zug, the heart of Switzerland’s “Crypto Valley,” announced that it had hired Citigroup to advise it on acquisitions, taking advantage of a strong financial position while many of its competitors flailed with insolvencies or simply the crypto downturn.

Most notably, with the stated aim of strengthening its presence in Asia, Nexo is in talks to buy Singapore-based Vauld, one of the crypto lenders than halted withdrawals by customers who entrusted it with their crypto in exchange for interest.

That is the same financial product that led the attorneys general of New York, California and six other states to sue Nexo on Sept. 26.

That lawsuit follows on the $100 million settlement in February by BlockFi, a leading crypto lender, for selling unregistered securities in the form of those interest-bearing deposits with/investments in crypto lending. Half of that went to several dozen states and the rest to the Securities and Exchange Commission (SEC).

Buying Spree

Nexo is hardly the only company using that downturn to go shopping.

BlockFi became insolvent in the current crisis, but was rescued by FTX CEO Sam Bankman-Fried, who has been on an accelerating acquisition spree since before the crypto winter bear market began. And earlier this week, his U.S exchange, FTX US won a bidding war for Voyager Digital’s assets, suggesting Bankman-Fried is planning to push ahead with its own FTX Earn product.

Generally speaking, crypto lenders require borrowers to put up crypto worth 125% to 150% of the amount they want to borrow, getting loans in stablecoins. That collateral is automatically sold if volatile crypto prices drive it too close to the amount borrowed. While those loans, which normally in stablecoins, can be used for any purpose, most is used in risky decentralized finance, or DeFi, investments.

Nexo stopped accepting new U.S. clients. While it did not halt the service for existing clients, it stop paying interest on new deposits. Those changes would be in place “until the restructuring of the Earn Interest Product and the registration process with the relevant regulatory bodies are finalized,” it said at the time.

September 23, 2022

Data Protection as a Service

Per a recent article in TechCrunch, “Companies are facing hundreds of millions of dollars in fines these days for failing to comply with data protection and data privacy rules, and that’s driving wave of organizations, and their users, to get more serious about data protection.”

Related Reading:

- Data Protection As A Service (DPaaS) Global Market Report 2022

The data protection as a service (DPaaS) market research report is one of a series of new reports that provides market statistics, including DPaaS industry global market size, regional shares, competitors with market share, detailed market segments, trends and data. - Uber’s Hacker *Irritated* His Way Into Its Network, Stole Internal Documents

Employee was spammed so much with MFA requests that he could easily be tricked into accepting one. Then the hacker found a terrible blunder on the internal network. - American Airlines Says Data Breach Affected Some Customers, Employees

American Airlines Inc (AAL.O) on Tuesday confirmed a data breach and said while an “unauthorized actor” gained access to personal information of a small number of customers and employees through a phishing campaign, there was no evidence of data misuse.

Courtesy of GlobeNewsWire and ReportLinker

The global data protection as a service (DPaaS) market is expected to grow from $17.88 billion in 2021 to $23.09 billion in 2022 at a compound annual growth rate (CAGR) of 29.1%. The data protection as a service (DPaaS) market is expected to grow to $63.38 billion in 2026 at a CAGR of 28.7%.

The global data protection as a service (DPaaS) market is expected to grow from $17.88 billion in 2021 to $23.09 billion in 2022 at a compound annual growth rate (CAGR) of 29.1%. The data protection as a service (DPaaS) market is expected to grow to $63.38 billion in 2026 at a CAGR of 28.7%.

The data protection as a service (DPaaS) market consists of sales of data protection as a service (DPaaS) by entities (organizations, sole traders, and partnerships) that are a collection of services that help organizations to protect their data and also improve their network security and recovery options.Data Protection-as-a-Service (DPaaS) is a cloud-based or web-based system for networking security and data loss prevention.

These services are provided to the clients through multiple memberships and help organizations in cutting the costs of system security and maintenance.

The main types of data protection as a service are disaster recovery as a service, backup as a service, and storage as a service.Disaster recovery as a service (DRaaS) is a cloud computing service model that enables an organization to back up its data and IT infrastructure in a third-party cloud computing environment and provides all DR orchestration, all through a SaaS solution, to regain access and functionality to IT infrastructure following a disaster.

Data protection as a service can be deployed in the public cloud, private cloud, and hybrid cloud in large enterprises and SMEs that can be used in various industries such as banking, financial services and insurance (BFSI), telecom & IT, government & public sector, healthcare, retail, energy & utilities, manufacturing, others.

North America was the largest region in the data protection as a service (DPaaS) market in 2021.Asia Pacific is expected to be the fastest-growing region in the forecast period.

The regions covered in the data protection as a service (DPaaS) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The increasing concern about data loss and data security is propelling the demand in the data protection as a service (DPaaS) market.Data loss refers to the loss of data due to internal issues like system failure or external issues like cyber attacks, etc.

Enterprises from all around the world have been concerned about data security recently due to incidents of data loss and data leaks.For instance, according to Identity Theft Resource Center’s report, a United States non-profit organization, the year 2021 saw 1,862 data breaches, which was up from 1,108 data breaches in 2020.

These breaches have increased concerns about data loss in companies. Hence, the increasing concerns about data loss and data security are driving the growth of the data protection as a service market.

New technological advancements like the integration of connected devices with the internet of things (IoT) and virtual private network (VPN) are shaping the data protection as a service (DPaaS) market.For instance, in May 2021, GLobal Electronic-SECurity (GLESEC), a cyber-security firm announced the launch of its new Orchestrated data leakage detection and protection service.

This security-as-a-service has a unique offering of detecting and protecting data leakage without the need to classify all the information of the company. With this service, the company would address the need for the organization’s security requirements.

In January 2021, Veritas, headquartered in California, a provider of enterprise data protection services, acquired HubStor for an undisclosed amount.With this acquisition, Veritas would add a SaaS-based data protection team to the team and would be able to bring data protection services to the cloud. Hubstor, headquartered in Canada, is data protection as a service provider. The countries covered in the data protection as a service (DPaaS) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

September 16, 2022

CFPB Study Details the Rapid Growth of “Buy Now, Pay Later” Lending

Business model relies on data collection, and loans serve as close substitute for credit cards

Today, the Consumer Financial Protection Bureau (CFPB) published a report offering key insights on the Buy Now, Pay Later industry. The report, Buy Now, Pay Later: Market trends and consumer impacts , finds that industry grew rapidly during the pandemic, but borrowers may receive uneven disclosures and protections. The five firms surveyed in the report originated 180 million loans totaling over $24 billion in 2021, a near tenfold increase from 2019.

Today, the Consumer Financial Protection Bureau (CFPB) published a report offering key insights on the Buy Now, Pay Later industry. The report, Buy Now, Pay Later: Market trends and consumer impacts , finds that industry grew rapidly during the pandemic, but borrowers may receive uneven disclosures and protections. The five firms surveyed in the report originated 180 million loans totaling over $24 billion in 2021, a near tenfold increase from 2019.

“Buy Now, Pay Later is a rapidly growing type of loan that serves as a close substitute for credit cards,” said CFPB Director Rohit Chopra. “We will be working to ensure that borrowers have similar protections, regardless of whether they use a credit card or a Buy Now, Pay Later loan.”

Related Reading: Director Chopra’s Prepared Remarks on the Release of the CFPB’s Buy Now, Pay Later Report

Read the Report: Buy Now, Pay Later: Market trends and consumer impacts

Buy Now, Pay Later is a form of interest-free credit that allows a consumer to fully purchase a product, and then pay back the loan over four installments, with the first installment typically being a down payment on the purchase. Most Buy Now, Pay Later loans range from $50 to $1,000, and are subject to late fees if a borrower misses a payment.

Buy Now, Pay Later rose to prominence in the past decade as an alternative form of credit for online retail purchases. The lending option has gained traction with consumers who seek the flexibility of being able to pay for goods and services over time, but who may have been leery of other credit products.

Buy Now, Pay Later rose to prominence in the past decade as an alternative form of credit for online retail purchases. The lending option has gained traction with consumers who seek the flexibility of being able to pay for goods and services over time, but who may have been leery of other credit products.

Once a niche financial offering that was heavily concentrated in apparel and beauty, Buy Now, Pay Later has now branched out to industries as disparate as travel, pet care, and even groceries and gas. Apparel and beauty merchants, who had combined to account for 80.1% of originations in 2019, only accounted for 58.6% of originations in 2021.

Other highlights of Buy Now, Pay Later loan usage include:

- Loan approval rates are rising: 73% of applicants were approved for credit in 2021, up from 69% in 2020.

- Late fees are becoming more common: 10.5% of unique users were charged at least one late fee in 2021, up from 7.8% in 2020.

- More purchases are ending in returns: 13.7% of individual loans in 2021 had at least some portion of the order that was returned, up from 12.2% in 2020.

- Lenders’ profit margins are shrinking: Margins in 2021 were 1.01% of the total amount of loan originated, down from 1.27% in 2020.

The marketing of Buy Now, Pay Later loans can make them appear to be a zero-risk credit option, but today’s report identified several areas of risk of consumer harm, including:

- Inconsistent consumer protections: Borrowers seeking Buy Now, Pay Later credit may encounter products that do not offer protections that are standard elsewhere in the consumer financial marketplace. These include a lack of standardized cost-of-credit disclosures, minimal dispute resolution rights, a forced opt-in to autopay, and companies that assess multiple late fees on the same missed payment.

- Data harvesting and monetization: Many Buy Now, Pay Later lenders are shifting their business models toward proprietary app usage, which allows them to build a valuable digital profile of each user’s shopping preferences and behavior. The practice of harvesting and monetizing consumer data across the payments and lending ecosystems may threaten consumers’ privacy, security, and autonomy. It also may lead to a consolidation of market power in the hands of a few large tech platforms who own the largest volume of consumer data, and reduce long-term innovation, choice, and price competition.

- Debt accumulation and overextension: Buy Now, Pay Later is engineered to encourage consumers to purchase more and borrow more. As a result, borrowers can easily end up taking out several loans within a short time frame at multiple lenders or Buy Now, Pay Later debts may have effects on other debts. Because most Buy Now, Pay Later lenders do not currently furnish data to the major credit reporting companies, both Buy Now, Pay Later and other lenders are unaware of the borrower’s current liabilities when making a decision to originate new loans.

Buy Now, Pay Later providers are subject to some federal and state oversight. The CFPB has enforcement authority over providers of credit, and it has authority to supervise any non-depository covered persons, such as a Buy Now, Pay Later provider, in certain circumstances. Some states consider Buy Now, Pay Later to be consumer credit and require state licensing or registration, as well as compliance with state consumer credit laws, while other states do not require licensing or registration for Buy Now, Pay Later products with no interest or finance charges.

To address the discrete consumer harms, the CFPB will identify potential interpretive guidance or rules to issue with the goal of ensuring that Buy Now, Pay Later lenders adhere to many of the baseline protections that Congress has already established for credit cards. As part of this review, the agency will also ensure Buy Now, Pay Later lenders, just like credit card companies, are subjected to appropriate supervisory examinations.

To address emerging risk issues with data harvesting, the CFPB will identify the data surveillance practices that Buy Now, Pay Later lenders should seek to avoid.

To reduce the risk of borrower overextension, the CFPB will continue to address how the industry can develop appropriate and accurate credit reporting practices. The agency will also take steps to ensure the methodology used by the CFPB and the rest of the Federal Reserve System to estimate household debt burden is rigorous.

Today’s report comes after the Bureau announced a market monitoring inquiry in December 2021 to gain more insight into the industry. In January 2022, the CFPB submitted a public notice and request for comments from the public on their experiences dealing with Buy Now, Pay Later loans. The data and insights in the report are based on feedback from that request, along with deidentified submissions in the public CFPB complaint database and publicly available financial filings and other source material from the five firms who received the Bureau’s market monitoring orders.

Consumers having an issue with a Buy Now, Pay Later product or service, or any other consumer financial product or service can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

September 9, 2022

The Cost of a Data Breach: Banking and Finance

Courtesy of Mark Stone, Security Intelligence

The importance of cybersecurity has touched almost every industry. Beyond that, robust cybersecurity is table stakes for several sectors, particularly health care and the banking and finance industry. Not only is financial data at risk, but so is customer trust. In banking and finance, trust means everything.

Yet, consumers are hesitant to share their confidential data. A recent McKinsey survey revealed that no industry achieved a trust rating of 50% for data protection. Here’s the most sobering stat: 87% of respondents said they’d refuse to do business with any company that they perceived as having weak security practices.

Related Reading

2022 Cost of a Data Breach Report: The average total cost of a data breach is $4.35 million, according to the new 2022 report from the Ponemon Institute. Explore cost factors, root causes and security best practices in this series.

KeyBank: Hackers of Third-Party Provider Stole Customer Data: Hackers stole personal data including Social Security numbers, addresses and account numbers of home mortgage holders at KeyBank, the bank reports, in the breach of a third-party vendor that serves multiple corporate clients.

Robinhood’s $20 Million Data Breach Settlement: The stock-trading app lacks “almost universal security measures,” according to a class action suit leading to the multi-million dollar payout.

Capital One to Pay Out $190M After Hacker Breached Millions of Customers’ Data: Capital One Financial Corp. has reached an agreement to pay $190 million to settle a class-action lawsuit that was filed after a hacker accessed personal information belonging to 100 million U.S. customers.

When banking and finance data breaches occur — and they do happen often — they don’t always stem from a bad actor. Often, breaches come from poorly secured third-party apps or a lack of proper user authentication protocols.

Banking and Finance Data Breaches

Banking and Finance Data Breaches

Several data breaches struck these industries over the last year. What can we learn from them?

In January of 2021, attackers breached the accounts of three million Morgan Stanley corporate customers. The breach, reported in July, involved a third-party vendor. Attackers could access client names and addresses, social security numbers, date of birth and company names. The bank reported that attackers successfully exploited a vulnerability in the vendor’s server. Although the vulnerability was quickly patched, attackers still managed to obtain a decryption key for the encrypted files.

In December of 2021, crypto exchange Bitmart suffered a large-scale security breach. Attackers made away with $200 million worth of cryptocurrency. And all the bad actors had to do? Steal a single private key.

In November of 2021, online trading platform Robinhood announced a data security incident that affected millions of its customers. The company divulged that an “unauthorized third party” was able to obtain the email addresses of five million people and the full names of two million others. For 310 users, “additional personal information” was stolen. The attackers allegedly demanded a ransom payment following the breach.

How Much Does a Financial Breach Cost in 2022?

According to the 2022 IBM Cost of a Data Breach Report, the finance industry had the second highest average cost per breach, trailing only health care. While the average health care breach costs hit a new record high of $10.10 million (an increase of almost 42% since the 2020 report), financial organizations averaged $5.97 million per breach.

On a positive note, the Cost of a Data Breach report revealed that the average number of days to identify and contain a data breach fell from 287 in 2021 to 277 in 2022, a reduction of 10 days or 3.5%. The average number of days to contain a breach also fell in 2022 — from 75 days in 2021 to 70 days in 2022.

Risks and Challenges for Banking and Finance

Costly data breaches are only one side of the coin.

First, the industry must keep up with evolving digital transformation and technology innovations. Digital services, cloud computing and artificial intelligence (AI) play a key role. To meet customer demand, financial institutions must leverage more new applications, devices and infrastructure components. These, in turn, only increase their attack surface.

Next, banking and finance are subject to more complex regulations with each passing year. Data protection and privacy standards constantly change, and fines for non-compliance increase.

Third-party risk management is critical for any industry. However, banking and finance must be extra vigilant in ensuring vendors and third-party suppliers are secure. Third-party breaches underscore the financial services sector’s potential vulnerability to cyberattacks. After all, it increasingly relies on suppliers and vendors who cannot guarantee cybersecurity.

Finally, as the hybrid workplace gains popularity, so does an organization’s risk. Remote and hybrid work presents a more daunting challenge for industries with more critical data to protect.

Lowering Data Breach Costs

Although the threat landscape is expanding and breaches happen, proactive security measures work. The Cost of a Data Breach report shows how current security strategies can lower the average cost of a breach.

Security AI and Automation

Organizations that employ security automation like AI, machine learning, analytics and automated security orchestration saved on average $3.05 million per breach compared to firms using no security AI and automation.

Extended Detection and Response

2022 is the first time the report examined the effects of Extended Detection and Response (XDR) technologies on the cost of a data breach. Notably, organizations that deployed advanced threat detection and response tools averaged a savings of 9.2% per breach. While these savings may not seem significant, the true impact is realized in the reduction of breach duration — nearly one month.

Incident Response

Companies that have dedicated incident response (IR) teams and test their IR plan significantly reduced the average cost of a data breach by $2.66 million per breach compared to those with no IR team or no IR testing in place.

Risk Quantification

Risk quantification can highlight financial loss types by impact, loss of productivity, cost of response or recovery, reputation impact and fines and judgments. Companies using risk quantification saved $2.10 million per breach on average versus those that don’t.

Zero Trust

The zero trust approach assumes that user identities or the network itself may already be compromised. Instead, it relies on AI and analytics to continuously validate connections between users, data and resources. Not surprisingly, zero trust has a net positive impact on data breach costs, saving companies with a mature zero trust deployment $1.51 million on average per breach versus those with early adoption of zero trust.

These statistics provide the dose of optimism the industry needs. As more organizations invest in proactive security strategies and better cloud management practices, the impact and risk of a data breach can be reduced.

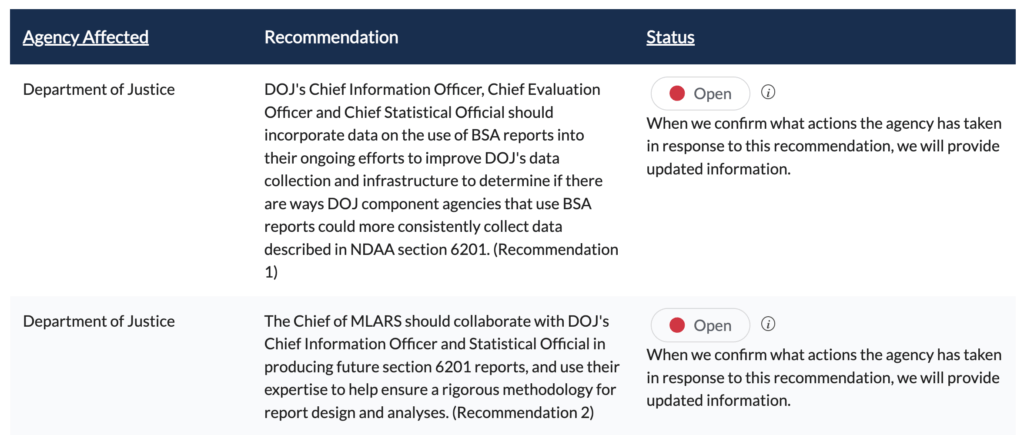

September 2, 2022 — Bank Secrecy Act: Action Needed to Improve DOJ Statistics on Use of Reports on Suspicious Financial Transactions

Courtesy of the U.S. Governmental Accountability Office

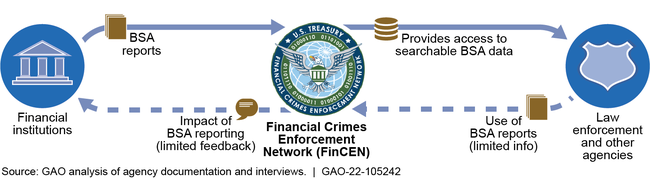

Bank Secrecy Act (BSA) provisions for reporting suspicious financial transactions are intended to help law enforcement detect and investigate illicit finance activity. In GAO-19-582, Governmental Accountability Office (GAO) reported that financial institutions wanted more feedback on the usefulness of the BSA reports they file with Financial Crimes Enforcement Network (FinCEN).

Bank Secrecy Act (BSA) provisions for reporting suspicious financial transactions are intended to help law enforcement detect and investigate illicit finance activity. In GAO-19-582, Governmental Accountability Office (GAO) reported that financial institutions wanted more feedback on the usefulness of the BSA reports they file with Financial Crimes Enforcement Network (FinCEN).

The 2021 NDAA directs DOJ to annually report statistics on law enforcement agencies’ use of BSA reports, and directs FinCEN to provide additional feedback. The 2021 NDAA also contains a provision for GAO to report on practices that could improve BSA-related feedback. Among its objectives, this report examines steps DOJ and FinCEN have taken to implement these provisions.

GAO reviewed applicable laws, regulations, and agency documents, and interviewed officials from FinCEN, DOJ, other law enforcement agencies, and industry associations.

Fast Facts

Illegal financial activity can threaten safety and national security. Banks must report potentially illegal transactions to the Financial Crimes Enforcement Network (FinCEN), which makes the reports available to law enforcement agencies to help with investigations.

But law enforcement agencies usually don’t track data on the usefulness of these reports, so FinCEN can’t provide feedback to banks about the reports’ effectiveness.

To facilitate this feedback, the Department of Justice is required to provide information about the usefulness of these reports. But DOJ doesn’t collect adequate data to do so. Our recommendations address these issues.

Highlights: What GAO Found

The Financial Crimes Enforcement Network (FinCEN) is responsible for administering the Bank Secrecy Act (BSA), which requires financial institutions to file reports about suspicious financial transactions. FinCEN provides BSA report access to law enforcement agencies, which use those reports to support investigations. FinCEN receives limited data from law enforcement agencies on their use of BSA reports or the reports’ impact on case outcomes because agencies largely do not collect such data. As a result, FinCEN cannot provide comprehensive feedback to financial institutions on the usefulness of the BSA reports they file.

Feedback Loop for Bank Secrecy Act (BSA) Reporting

The 2021 National Defense Authorization Act (NDAA) directs the Department of Justice (DOJ) to provide annual statistics, metrics, and other information to the Secretary of the Treasury on agencies’ use of BSA reports, including how often reports contributed to arrests and convictions. But none of the agencies that DOJ contacted, including DOJ component agencies, provided the statistics described in the NDAA. DOJ’s first annual report focused on qualitative information and statistics already available to FinCEN. DOJ stated that agencies faced challenges collecting data that connect their use of BSA reports to case outcomes using current data systems.

DOJ has opportunities to leverage existing initiatives and expertise to improve its annual statistical report on agencies’ use of BSA reports.

- DOJ has been implementing a comprehensive, agency-wide data strategy to improve its data collection and infrastructure, but BSA-related data have not been included in the agencies’ efforts. Including these data would give DOJ an opportunity to examine how to improve its component agencies’ data collection on their use of BSA reports.

- DOJ’s first annual statistical report on BSA reflected some methodological weaknesses. For example, it did not include data from two agencies that track some uses of BSA reports because DOJ did not have procedures for following up on its data requests. The DOJ office that drafted the report did not collaborate with DOJ’s Chief Information Officer or Statistical Official in the report’s design. By involving the expertise of these DOJ offices in the development of future annual reports, DOJ could better ensure a rigorous methodology for collecting and presenting the report’s required statistics.

Recommendations

GAO recommends that DOJ (1) include data on the use of BSA reports in its ongoing agency-wide efforts to improve data collection, and (2) involve its Chief Information Officer and Statistical Official, in the design of its annual BSA statistical report. DOJ neither agreed nor disagreed with the recommendations.

Recommendations for Executive Action

Report’s Conclusions

FinCEN has made some progress in providing more feedback to institutions that file BSA reports, and its planned domestic liaison office is a step in improving feedback further. But FinCEN’s ability to provide feedback on the impact of BSA reports is limited because it depends on other agencies tracking their use of BSA reports, and agencies face challenges linking BSA reports to outcomes.

Thus, facilitating data collection on the use of BSA reports is a necessary first step to providing comprehensive feedback on the value of BSA reporting. By including data on the use of BSA reports in its ongoing efforts to build capacity for data collection, DOJ may identify data system improvements and other ways for its component agencies that use BSA reports to track their use. While DOJ component agencies are not the only users of BSA data, they represent a substantial portion of such users and could demonstrate best practices for effectively tracking the use of BSA reports to other agencies.

Beyond the need for additional data collection, the value of DOJ’s first annual report on the impact of BSA reports was limited because it lacked some available data and reflected some methodological weaknesses. By leveraging the expertise of DOJ data offices in the development of future summary reports, the agency could help ensure a rigorous methodology is used for collecting and presenting the report’s required statistics and also improve the quality of the information it provides to FinCEN. By taking both these steps, DOJ ultimately could improve the feedback FinCEN gives to filing institutions on the use and usefulness of their BSA reporting.

August 26, 2022 Feature: 57th Annual State System Summit

![]() Attendees can click here to access presentations and more.

Attendees can click here to access presentations and more.

(Event registration and MFA required.)

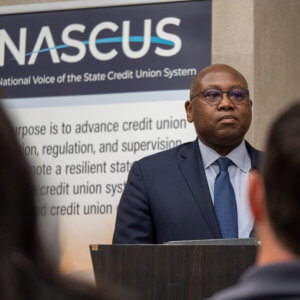

Hosted in sunny Huntington Beach, CA, the 57th Annual State System Summit (S3) brought together more than 100 industry leaders, including state and federal regulators, credit union CEOs, industry leaders, and experts, to share best practices and collaborate on industry issues.

Welcome to California

One of the benefits of attending the National Association of State Credit Union Supervisors (NASCUS) S3 is the ability to network and collaborate with credit union industry professionals from across the country to exchange ideas and resources. NASCUS President and CEO Brian Knight opened the event, introducing NASCUS Board Chairs Rose Conner and Mike Williams to welcome attendees and speak about the vitality of the state system.

California’s own Diana Dykstra, President/CEO of CA/NV Credit Union Leagues, warmed up the crowd and highlighted the innovations and history of the credit union system within the state.

California’s own Diana Dykstra, President/CEO of CA/NV Credit Union Leagues, warmed up the crowd and highlighted the innovations and history of the credit union system within the state.

“Here in California, the very first credit union was established in 1921…a postal credit union…Today, we have 296 with $281 billion in total assets, 13 million members, and 1631 branches…I’m proud to be a NASCUS member and long-time supporter. What you do is extremely important. Collaboration, innovation, and improving the charter is what you do best.”

Senior Deputy Commissioner, Department of Oversight, California Department of Financial Protection & Innovation (DFPI), Ed Gill, emphasized his agency’s continuous growth and evolution.

Senior Deputy Commissioner, Department of Oversight, California Department of Financial Protection & Innovation (DFPI), Ed Gill, emphasized his agency’s continuous growth and evolution.

“We’ve recently seen our authority expanded throughout through statute. We now oversee debt collectors and student loan services…non-bank small business lenders, fintech companies, debt relief companies, consumer credit reporting agencies, and other covered persons…Furthermore. Gov Governor Gavin Newsom recently issued an executive order directing a multi-agency approach to develop effective oversight of blockchain and crypto assets.”

![]() Click here to view the 2022 State System Summit Photo Album

Click here to view the 2022 State System Summit Photo Album

Hot Topics: Evolving Technologies and Threats

In a world of “crypto-curious” entities, the global financial system needs to define rapidly evolving technologies, determine safe parameters, and map out best practices. As a result, NASCUS hosted a panel discussion on the variables surrounding Distributed Ledger Technology (DLT) moderated by Chelsea Treboniak, Owner of Critical Ops, with a panel of industry experts, including the Honorable Kyle Hauptman, Vice Chairman of the NCUA, Becky Reed, CEO of Lone Star Credit Union, and John Wingate, CEO of BankSocial.

In a world of “crypto-curious” entities, the global financial system needs to define rapidly evolving technologies, determine safe parameters, and map out best practices. As a result, NASCUS hosted a panel discussion on the variables surrounding Distributed Ledger Technology (DLT) moderated by Chelsea Treboniak, Owner of Critical Ops, with a panel of industry experts, including the Honorable Kyle Hauptman, Vice Chairman of the NCUA, Becky Reed, CEO of Lone Star Credit Union, and John Wingate, CEO of BankSocial.

DLT serves as a record of consensus with a cryptographic audit chain validated by nodes. With blockchain functioning as a variant of DLT and cryptocurrency as an encrypted data string that denotes a unit of currency, this panel openly analyzed the links and differences surrounding these evolving components.

“The real game changer here is distributed ledger technology, where you’re taking what we used to do with databases and decentralized data services. And now distributing it, you get more resilience across the system, you get more transparency across the system…distributed ledger is the real game changer here, not blockchain,” commented John Wingate.

This panel discussion incorporated audience-based questions and engagements touching on topics such as state-based crypto working groups, Central Bank Digital Currency development, potential Federal Reserve actions, smart contracts, and more.

Immediately following the DLT session, attendees participated in a series of roundtable activities on cybersecurity. In this session, participants worked side-by-side with peers to “think like the bad actors” and troubleshoot opportunities to mitigate vulnerabilities in various scenarios, including fraud, cybersecurity, and automated processes.

Special Guests and Celebrations

Each year, NASCUS celebrates an individual and their career-long efforts with the Pierre Jay Award. This award acknowledges a career of “proven service, commitment, and leadership to NASCUS and the state-charter system.” That honor was bestowed to former Connecticut Financial Institutions Division Director Mary Ellen O’Neill this year.

Each year, NASCUS celebrates an individual and their career-long efforts with the Pierre Jay Award. This award acknowledges a career of “proven service, commitment, and leadership to NASCUS and the state-charter system.” That honor was bestowed to former Connecticut Financial Institutions Division Director Mary Ellen O’Neill this year.

“On behalf of the NASCUS leadership and staff, I want to congratulate Mary Ellen on her achievement. This award honors her considerable impact on the health and well-being of the state system,” commented Brian Knight, President and CEO of NASCUS. “She has dedicated her career to ensuring a safe, sound, and robust dual charter system, and we are deeply grateful for her friendship and contributions throughout her career.”

In addition to celebrating state system accomplishments, NASCUS is investing in the future. Each year, the National Association of Credit Union Service Organizations (NACUSO) hosts a “Big Idea” Competition illustrating “innovation and drive for advancements within the industry.” In April, Illuma Labs and Posh Technologies won the honor of being this year’s Big Idea. The end product integrated the Illuma Shield™ passive voice authentication solution with conversational AI IVR from Posh to securely enable credit union members to access their accounts by voice recognition verification.

In addition to celebrating state system accomplishments, NASCUS is investing in the future. Each year, the National Association of Credit Union Service Organizations (NACUSO) hosts a “Big Idea” Competition illustrating “innovation and drive for advancements within the industry.” In April, Illuma Labs and Posh Technologies won the honor of being this year’s Big Idea. The end product integrated the Illuma Shield™ passive voice authentication solution with conversational AI IVR from Posh to securely enable credit union members to access their accounts by voice recognition verification.

“I had the pleasure of presenting alongside Karan Kashyap at the NASCUS S3 event on how Illuma and Posh Technologies are collaborating to provide enhanced member experience and security at credit union contact centers through the graceful fusion of our AI and voice authentication technologies. Thank you, NASCUS, for having us at the event and for all the insightful questions from the attendees,” said Milind Borkar, Founder/CEO of Illuma.

During the Annual Meeting, NASCUS announced new officers and newly elected and appointed directors to the NASCUS Regulator Board and Credit Union Advisory Council.

- Oregon Division of Financial Regulation’s Janet Powell was elected to the position of Board Chair on the Regulator Board (3-year term)

- Washington Department of Financial Institutions’ Amy Hunter was elected to the position of Director on the Regulator Board (3-year term)

- North Dakota Department of Financial Institutions’ Corey Krebs was appointed to the position of Director on the Regulator Board (1-year term)

- Southeast Financial Credit Union’s Jeff Dahlstrom (TN) was elected to the position of Credit Union Advisory Council Chair (3-year term)

- VyStar Credit Union’s Brian Wolfburg (FL) was elected to the position of Credit Union Advisory Council Vice-Chair (3-year term)

- TruMark Financial Credit Union’s Rick Stipa (PA) was elected to the position of Credit Union Advisory Council Director (3-year term)

- Metro Credit Union’s Robert Cashman (MA) was appointed to the position of Credit Union Advisory Council Director (1-year term)

Strategies for the Future

Over the course of three pack-filled days, NASCUS guests participated in a series of networking activities, learning opportunities, and position-specific problem-solving meetings. State regulators met in an afternoon of segmented meetings to discuss inter-agency topics, best practices, and commonalities between states. Credit unions and Credit Union Leagues participated in specialized sessions covering issues such as strategy development with Filene Institute’s Mark Meyer and Fraud Schemes with Frank Drake from Smith Debnam Narron Drake Saintsing & Myers, LLP.

Over the course of three pack-filled days, NASCUS guests participated in a series of networking activities, learning opportunities, and position-specific problem-solving meetings. State regulators met in an afternoon of segmented meetings to discuss inter-agency topics, best practices, and commonalities between states. Credit unions and Credit Union Leagues participated in specialized sessions covering issues such as strategy development with Filene Institute’s Mark Meyer and Fraud Schemes with Frank Drake from Smith Debnam Narron Drake Saintsing & Myers, LLP.

Throughout the week, attendees enjoyed deep dives into topics with experts such as:

- Dr. Robert Eyler’s (Interim Associate Vice President of Government Relations and Professor of Economics at Sonoma State University) presentation on recent economic forecasts and national trends in terms of recovery, housing markets, interest rates, and inflation and the effects on members nationwide;

- Steven Jung’s (Vice President/Regional Sales Director, Federal Reserve Bank of Chicago) introduction to FedNow and the enablement of instant payments;

- Bryan Mogensen’s (Principal, CLA [CliftonLarsonAllen LLP]) perspective on the challenges facing the credit unions system with a continued focus on strategic and operational planning, new growth opportunities, CECL, the war on talent, and more;

Looking Ahead

As we move into the future, attendees noted sensitivities to other potential issues, including data protection, complications with AI technologies such as multi-lingual necessities and authentication, synthetic identity fraud, and more. The event emphasized the idea that technology is driving innovation, collaboration, and conversation.

As we move into the future, attendees noted sensitivities to other potential issues, including data protection, complications with AI technologies such as multi-lingual necessities and authentication, synthetic identity fraud, and more. The event emphasized the idea that technology is driving innovation, collaboration, and conversation.

Events like these are essential to the state system, providing a stage for discovery, extensive issue remediation, and collaboration. NASCUS wants to thank this year’s event sponsors for making this event possible,

In 2023, NASCUS will host the 58th Annual State System Summit in Nashville, TN.

Last but not least, NASCUS invites you to join us for other topic-specific educational and networking events, such as our Director’s Colleges, Industry Day, Examiner Schools, the 2023 Cannabis Symposium, and more. Bookmark the NASCUS Education and Events page to stay up-to-date on current offerings.

August 12, 2022 OPINION: The Trip Back to Reality Starts: Mortgages, HELOCs, Delinquencies, and Foreclosures in Q2

Forbearance and pandemic cash run out. But a lot of fun was had by all.

Courtesy of Wolf Richter, WolfStreet.com

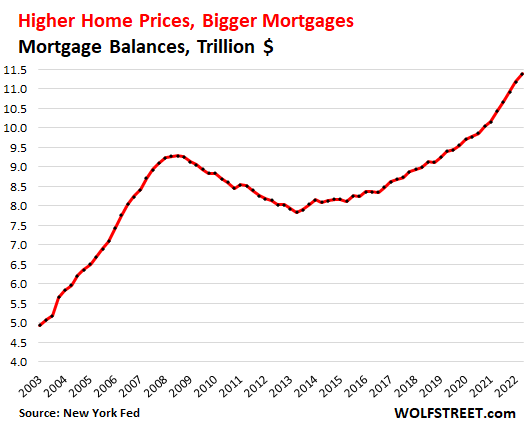

August 5, 2022 — Mortgage balances jumped by 9% in Q2 from a year ago, as prices spiked year-over-year, while people bought far fewer homes – sales of existing homes dropped by 10% from Q2 last year, and sales of new single-family houses plunged by 19% over the same period.

Mortgage balances have surged relentlessly since the end of the Housing Bust in 2012. Over those 10 years, mortgage balances surged by $4.6 trillion, and over the past three years, mortgage balances surged by $2.0 trillion, or by 21%, to $11.4 trillion, according to data from the New York Fed’s Household Debt and Credit Report.

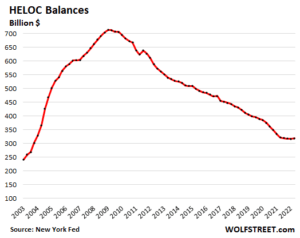

HELOCs end long decline.

Home Equity Lines of Credit fell out of favor after 2009 and balances declined steadily, unwinding the massive surge of the years before the Financial Crisis. As the Fed’s interest-rate repression and QE pushed down mortgage rates, and as home prices rose, folks began to cash-out-refinance their mortgages to generate cash, rather than drawing on HELOCs.

But now the decline has ended. HELOC balances ticked up in Q2 to $319 billion, from the low in the prior quarter. This has occurred as mortgage rates have spiked, and as cash-out refis have plunged.

There is now a new dynamic in place: Much higher mortgage rates: It would be stupid to refinance a 3% mortgage with a 5% mortgage in order to draw $100,000 in cash out of the home. It’s better to leave the 3% mortgage alone, and get a $100,000 HELOC that charges 5% on the outstanding balance, if any. So I expect HELOC balances to rise further going forward because the cash-out refi game has changed.

Mortgages are by far the biggest part of consumer debt, bigger than ever.

Nothing comes even close. Consumer debt balances in Q2:

-

- Mortgages: $11.4 trillion

- Student loans: $1.6 trillion

- Auto loans: $1.5 trillion

- Credit cards: $890 billion

- “Other” (personal loans, etc.): $470 billion

- HELOCs: $320 billion.

Mortgages is where the big systemic risks used to be due to the sheer size of the market and the high leverage.

But now, commercial Banks in the US only hold about $2.4 trillion of residential mortgages, including HELOCs, on their balance sheets, and those are spread among 4,300 commercial banks. Thousands of Credit Unions and other lenders also hold some mortgages on their balance sheets.

But most mortgages are now securitized into mortgage-backed securities. MBS fall into two categories:

- Most are government-backed MBS. Here the taxpayer is on the hook, not investors and lenders.

- A smaller portion of MBS are “private label” – not backed by government entities. They’re held by global bond funds, pension funds, insurance companies, etc.

Delinquencies start trip back to reality. A lot of fun was had by all.

Under the pandemic-era forbearance programs, homeowners that fell behind on their mortgage payments, or stopped making mortgage payments altogether, and then entered into a forbearance program, were reclassified to “current” instead of delinquent. They didn’t have to make mortgage payments, and could use the cash saved from those not-made mortgage payments for other stuff. Eventually, they would have to work out a deal with the lender to exit the forbearance program.

The spike in home prices since spring 2020 allowed homeowners, when it came time to exit the forbearance program, to either sell the home and pay off the mortgage and walk away with extra cash; or work out a deal with the lender, such as a modified mortgage with a longer term, a lower rate, and lower payments. And a lot of fun was had by all.

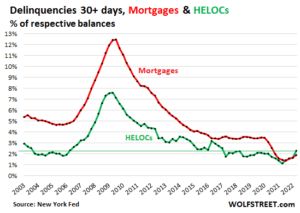

But with forbearance programs over, mortgage delinquencies started to rise this year from the record lows last year.

Mortgage balances that were 30 days or more delinquent rose to 1.9% of total mortgage balances in Q2, up from 1.7% in Q1. It was the third quarter-to-quarter increase in a row, from the record low in Q2 2021. But it remains below all pre-pandemic low points (red line).

HELOC balances that were 30 days or more delinquent rose to 2.3% of total HELOC balances, the fourth quarter-to-quarter increase in a row, from the record low in Q2 2021. They’re now higher than they were before the Housing Bust (green line).

The HELOC delinquency rate in Q2 was higher than the mortgage delinquency rate for the first time ever, which makes you go hmmm.

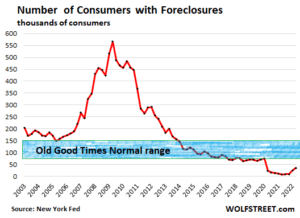

Foreclosures rose, but are still near record lows.

The number of consumers with foreclosures rose to 35,120 borrowers, up from 24,240 in Q1 and up from the record low range of 8,100 to 9,600 last year.

Foreclosures are still far below any of the prior lows before the pandemic. At the low point in Q2 2005, during the Best of Times just before the Housing Bust took off, there were 148,780 foreclosures, over four times as many as now.

By comparison, during the three-year time span from 2008 through 2011, the peak of the mortgage crisis, over 400,000 consumers per quarter had foreclosures, including 566,180 at the peak in Q2 2009.