Pennsylvania Attorney General Dave Sunday is among a coalition of 32 attorneys general that are urging Congress to pass the SAFER Banking Act of 2025.

In a letter to congressional leaders, Sunday and the coalition say the passage of the legislation that would provide legal clarity for banks and financial institutions to serve state-regulated cannabis businesses.

The letter emphasizes that current federal banking restrictions create unnecessary public safety risks by forcing legitimate cannabis businesses to operate primarily in cash. This makes employees and customers of cannabis businesses targets for violent crime. It also undermines states’ ability to effectively regulate and tax these industries.

Currently, 39 states, three territories, and the District of Columbia permit medical cannabis use, while 24 states, two territories, and the District of Columbia have legalized adult-use cannabis.

The AGs point out that the SAFER Banking Act would not encourage cannabis legalization in states that have chosen not to permit it, nor would it change cannabis’s federal legal status. Instead, the legislation creates a targeted safe harbor allowing depository institutions to provide financial services to covered businesses in states that permit the sale and use of cannabis.

Bringing cannabis commerce into the regulated banking system would enable law enforcement; federal, state, and local tax agencies; and cannabis regulators to more effectively monitor cannabis businesses and their transactions. Further, they state that compliance with tax laws would be simpler and easier to enforce with regulated tracking of funds in the banking system, resulting in higher tax revenues.

Joining Sunday in filing the letter are the attorneys general of Maryland, Ohio, Georgia, the District of Columbia, Alaska, American Samoa, Arizona, California, Colorado, Connecticut, Delaware, Hawai’i, Illinois, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, New York, Northern Mariana Islands, Oklahoma, Oregon, Rhode Island, South Dakota, U.S. Virgin Islands, Utah, Vermont, Washington, and West Virginia.

Courtesy of Dave Kovaleski, Financial Regulation News

Executive Summary

- Gutting the Consumer Financial Protection Bureau, chopping back regulatory staff at other agencies, and tinkering with federal bank regulatory structure have marked the Trump administration’s strategy, with more likely to come.

- At the same time, major new initiatives in complex areas like AI and cryptocurrency are raising the stakes for the industry and the country.

- In times like this, Washington should be building up a talented cadre of regulators, rather than taking away the guardrails, says a veteran regulator, banker and fintech executive.

As we stand at the crossroads of technological transformation in financial services — AI, open banking, crypto innovation, embedded finance, real-time payments, agentic commerce and more — a question we need to ask as a country is:

Are our federal financial regulators adequately staffed and prepared for what’s next?

Over nearly four decades I have been a regulator, a banker, an executive of a fintech-turned-bank, and now a fintech executive.

I’ve seen this business from all sides. I’m concerned about what I see going on in Washington.

Regulatory Agencies Aren’t Businesses. Period.

Applying the same logic used to trim and streamline private businesses may have appeal at some levels, but this concept fails to account for a critical factor: Profit-oriented financial institutions are fundamentally different than federal agencies.

Financial institutions’ core mission is to generate returns for shareholders. That means they prioritize growth, innovation and competitiveness. Sometimes this pushes them to take on riskier ventures or pursue short-term profits aggressively. Many value customer trust and long-term stability, but those goals can clash with market pressures for growth and profit.

By contrast, government banking agencies are designed as guardrails for the financial system. Their north star isn’t profit — it’s public interest, consumer protection and systemic risk management. Agencies like the FDIC or the Federal Reserve focus on keeping banks solvent, ensuring fair practices and shielding the public from fallout during financial shocks.

Have we already forgotten the events of Financial Crisis? The bank closures of early 2023? The concerns about public confidence in the financial system?

Throughout my career in banking and fintech, I had a front-row seat. I saw the caliber of people who work in regulatory agencies. Contrary to what some may assume, there was minimal fluff or excess. What I saw were competent, experienced and deeply committed professionals — policy experts, examiners and application analysts — working hard to ensure our banking system remains safe, fair and competitive.

That’s why I find the deep staffing cuts ordered by the Trump administration concerning. Regulatory oversight isn’t bureaucracy for bureaucracy’s sake. It’s a form of risk mitigation for consumers, businesses and the broader financial system.

Courtesy of Virginia Varela, The Financial Brand

In a pivotal week for digital asset policy, federal banking regulators issued long-awaited guidance outlining risk-management expectations for crypto-asset safekeeping activities. The OCC, Federal Reserve and FDIC released a joint statement defining core risk management principles for banks that hold crypto-assets on behalf of customers, marking substantive federal guidance on crypto custody.

Meanwhile, Congress advanced a trio of high-profile crypto bills as part of a coordinated legislative push dubbed “Crypto Week.” The House passed the GENIUS Act, the CLARITY Act and the CBDC Anti-Surveillance State Act. The next day, the President signed the GENIUS Act into law, enacting the most significant digital asset law to date. The GENIUS Act is the first federal law to create a comprehensive regulatory framework for payment stablecoins, digital tokens pegged to the U.S. dollar and intended for payments. A full summary of the GENIUS Act is available here.

The White House also weighed in on tax policy, expressing support for a de minimis exemption for small crypto transactions.

This week, the Senate Banking Committee released its own discussion draft of digital asset market structure legislation. The Senate version contains key differences from the House’s CLARITY Act, including the introduction of a new category of digital assets called “ancillary assets.”

Together, these developments signal accelerating regulatory and legislative activity as policymakers move toward a more structured digital asset framework in the United States.

Congressional Updates

GENIUS Act, CLARITY Act and Anti-CBDC Bill Clear House During ‘Crypto Week’

- On July 18, the House wrapped up “Crypto Week,” a coordinated legislative effort led by the House Financial Services Committee, House Agriculture Committee and House leadership. Over the course of two days, the House passed three significant digital asset bills:

- GENIUS Act. On July 17, the House passed the GENIUS Act (S.1582) with a bipartisan vote of 308-122. The next day, the President signed the bill into law, enacting the most significant digital asset law to date. The GENIUS Act is the first federal law to create a comprehensive regulatory framework for payment stablecoins, digital tokens pegged to the U.S. dollar and intended for payments. A full summary of the GENIUS Act is available here.

- CLARITY Act. On July 17, the House passed the CLARITY Act (H.R.3633), by a vote of 294-134, with support from 78 Democrats. The bill would establish a market structure framework for digital assets, including a division of regulatory authority between the SEC and CFTC. The Senate is working on its own version of market structure legislation.

- CBDC Anti-Surveillance State Act. On July 17, the House passed the CBDC Anti-Surveillance State Act (H.R. 1919) by a narrower vote of 219-210. The Speaker of the House promised conservative members of Congress that he would include the legislation as part of the House National Defense Authorization Act for Fiscal Year 2026, which is must-pass legislation. The NDAA determines how defense funds can be used and sets Congress’ priorities for national security. Both the House and Senate Armed Services Committees have passed their versions of NDAA out of committee and are awaiting floor consideration. The language in H.R. 1919 would have to be included in the Senate and House versions during floor consideration as part of the underlying text or amendment that passes on the floor of the House and Senate. It can also be added during the conference committee, where the two bills will be reconciled.

Senate Banking Committee Releases Discussion Draft of New Market Structure Legislation

- On July 22, Senate Banking Chair Tim Scott (R-SC) and Sens. Cynthia Lummis (R-WY), Bill Hagerty (R-TN) and Bernie Moreno (R-OH) released a discussion draft of digital asset market structure legislation. While these members of the Senate Banking Committee, which has jurisdiction over the SEC, released a portion of the bill, the Senate Agriculture Committee, which has jurisdiction over the CFTC, is expected to release their draft of the bill in early September. The bill includes key differences from the House’s CLARITY Act, including provisions that would create a new category of digital tokens called “ancillary assets.”

Senate Agriculture Committee Holds Hearing on Oversight of Digital Commodities

- On July 15, the Senate Agriculture Committee held a hearing entitled “Stakeholder Perspectives on Federal Oversight of Digital Commodities.” The hearing centered on digital asset market structure legislation and the appropriate division of regulatory authority between the CFTC and the SEC.

- In his opening remarks, Chairman John Boozman (R-AR) emphasized that the CFTC should have exclusive jurisdiction over the trading of digital commodities. Several witnesses echoed this view. Others, however, advocated for a joint regulatory framework involving both the CFTC and SEC, reflecting ongoing debate over how best to structure oversight of the digital asset ecosystem.

House Appropriations Advances Funding Bill With Crypto Provisions

- On July 21, the House Appropriations Subcommittee on Financial Services and General Government (FSGG) advanced the FY 26 FSGG Appropriations Bill. The funding bill includes several provisions related to digital assets. It prohibits the Treasury Department from using funds to design, build or develop a U.S. Central Bank Digital Currency. See Sec. 130. It also directs the Treasury to report to Congress on the practicability of establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile. See Sec 137.

House Passes the Financial Technology Protection Act of 2025

- On July 21, the House voted under suspension of the rules to pass the Financial Technology Protection Act of 2025 (H.R. 2384). The bill would establish a Financial Technology Working Group to research how illicit actors use digital assets and develop legislative and regulatory proposals to enhance anti-money laundering and counter-illicit financing efforts. The group would be led by the Treasury’s Under Secretary for Terrorism and Financial Crimes and consist of members from federal agencies, financial institutions, private interest groups and blockchain companies.

House Ways and Means Holds Crypto Tax Hearing

- On July 16, the House Ways and Means Subcommittee on Oversight held a hearing entitled “Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century.” The hearing focused on establishing a framework for treating digital assets in the U.S. tax code.

Agency Updates

Federal Banking Regulators Clarify Crypto Asset Safekeeping Expectations

- On July 14, the OCC, Federal Reserve Board and FDIC issued a joint statement entitled “Crypto-Asset Safekeeping by Banking Organizations,” defining six core risk management principles for banks that hold crypto-assets on behalf of customers. The guidance emphasizes that regulators will be using existing laws, regulations and supervisory standards and are not introducing new requirements. The guidance clarifies that “safekeeping” refers specifically to “the service of holding an asset on a customer’s behalf,” and generally addresses:

- General Risk Management Considerations. Requiring that banks must conduct comprehensive risk assessments of their custodial activities, considering financial exposure, asset complexity, control frameworks, staff expertise and contingency planning.

- Cryptographic Key Management. Emphasizing generating, storing and securing cryptographic keys, to manage liability for losses or compromises.

- Additional Risk Management Considerations. Requiring analysis of vulnerabilities, dependencies and technology compatibility for each specific crypto asset before offering safekeeping services.

- Legal and Compliance Risk. Requiring strict adherence to BSA/AML, CFT measures OFAC and Travel Rule requirements, with customer agreements clearly outlining respective responsibilities of the parties.

- Third-Party Risk Management. Confirming that when using sub-custodians or vendors, a bank remains responsible, requiring due diligence on key management and control practices as well as in the event of an insolvency or operational disruption.

- Audit. Covering key management controls, asset transfer and settlement processes, IT systems and third-party providers (internal or external resources may be used).

SEC Considering Exemption to Incentivize Tokenization

- On July 17, at a press event, SEC Chair Paul Atkins said the agency is exploring an innovation exemption to incentivize tokenization within the SEC regulatory framework. He said the innovation exemption would permit novel ways of trading and more narrowly tailored forms of relief to facilitate the building of other components of a tokenized securities ecosystem. Atkins added that he has seen an increase in assets moving on chain.

- During an interview on the same day, Atkins expressed support for the SEC and CFTC working together. When asked if he would support a merger between the SEC and CFTC, Atkins responded that for years he’s supported a consolidation of the two agencies. However, he added that this should not be the priority. The two agencies should work together to ensure they are in sync to avoid uncertainty in the marketplace and bottlenecks in the process.

White House Preparing Executive Order for Alternative Assets in 401(k) Plans

- On July 17, as reported by the Financial Times, three people brief on the President’s plans said the President is expected to sign an executive order allowing alternative assets like digital assets to be included as investments in 401(k) plans. The Financial Times reported that the executive order would instruct regulatory agencies to review remaining roadblocks, allowing alternative investments to be included in professionally managed funds. This comes after the Department of Labor rescinded its crypto retirement plan guidance on May 28, which had discouraged the use of crypto in 401(k) plans.

White House Says the Administration Supports Crypto Tax Exemption

- On July 17, in a White House press briefing, the White House Press Secretary Karoline Leavitt said the President signaled support for a crypto tax de minimis exemption. Furthermore, she noted that the Administration is exploring legislative solutions to achieve the exemption. A crypto tax de minimis exemption would allow individuals to make cryptocurrency transactions under a specific threshold without tax reporting requirements.

- On a related note, Sen. Cynthia Lummis (R-WY) proposed legislation exempting capital gains on transactions involving digital assets of $300 or less, subject to an annual cap of $5,000 on the total amount of gains that can be excluded from taxation annually.

Gould Sworn in as Comptroller of the Currency

- On July 15, Jonathan Gould was sworn in as the 32nd Comptroller of the Currency by Deputy Secretary of the Treasury Michael Faulkender. Gould is replacing Rodney Hood, who served as acting Comptroller since February. Gould was nominated by the President for the role on February 11 and confirmed by the Senate on July 10. Gould previously worked at the OCC as Senior Deputy Comptroller and Chief Counsel from 2018 to 2021.

State Updates

- On July 14, the Conference of State Bank Supervisors (CSBS) sent a letter to House and Senate leaders requesting additional amendments to the GENIUS Act, specifically:

- Preemption for State Uninsured Depositories (Section 16(d)). The CSBS requested the elimination of Section 16(d) of the GENIUS Act, which if passed would prevent host state approval and supervision of money transmission and custody activities of uninsured banks with payment stablecoin subsidiaries. The letter stated that the “unprecedented erosion of long-standing host state authority to license and supervise traditional financial activities … would weaken vital consumer safeguards, invite regulatory arbitrage, and introduce needless financial stability risks.”

- Preemption of State Authority Over State-Chartered Bank Subsidiaries (Section 5(h)). The CSBS requested an amendment to Section 5(h) of the GENIUS Act to restore a state’s full authority to approve and supervise the activities of a permitted payment stablecoin issuer that is the subsidiary of a state-chartered bank.

- Application of State Consumer Financial Protection Law to Payment Stablecoin Issuers (Section 7(f) & Section 4(b)(1)). The CSBS requested an amendment to Section 4(b)(1) to clarify that state consumer protection laws are not preempted.

- On July 17, the CSBS issued a statement entitled “Stablecoin Framework Must be Sustainable.” The CSBS stated that they appreciate congressional support for many amendments requested by state supervisors to improve the final bill, particularly changes that promote parity for state-approved stablecoin issuers and narrow the scope of authorized activities for all stablecoin issuers. CSBS urged Congress to make additional changes to the GENIUS Act in future digital asset legislation.

Two U.S. Senators have introduced the Payment Choice Act, the latest attempt to ensure that consumers can use cash at physical retail stores. While several states and cities have passed similar laws, previous efforts to enact cash acceptance legislation at the federal level have stalled.

Under the proposal, businesses that accept in-person payments at a physical location would be required to accept cash for transactions up to $500. Additionally, retailers would be prohibited from charging cash-paying customers a higher price.

The bill’s sponsors, Senators Kevin Cramer (R-N.D.) and John Fetterman (D-Pa.), noted that approximately 4.5% of U.S. households lack access to banking services, making cash transactions necessary for these individuals. The Senators also argued that the dollar is the nation’s legal tender and that any business operating in the U.S. should be willing to accept it.

“Forcing the use of credit and debit cards or imposing premium prices on goods and services paid for with cash limits consumer choice,” Cramer said in a statement. “Americans should have the option of using cards or cash, but they should be the ones who make that choice.”

Consequences for Retailers

Cramer introduced an earlier version of the Payment Choice Act in 2023, but it failed to gain traction. Industry experts warn that eliminating cash could have serious consequences for small merchants, who have consistently opposed such measures.

“Merchants complain about the cost of accepting card payments, but the merchant also gets a lot of benefits from card payments, including not having to handle and control cash, reduced risk of armed robbery and theft by the staff, no night drops to make at the bank, etc.,” said Don Apgar, Director of Merchant Payments at Javelin Strategy & Research. “The full benefit of these savings are realized when the merchant eliminates cash and the all the associated supporting functions.

“If the merchant still accepts cash, even in small amounts, the big savings from not needing any cash functions are greatly diluted,” he said. “This is what is driving many merchants to add surcharges to credit card purchases, because as a business they can’t eliminate the cost of cash and yet still have to pay fees for card purchases.”

Similar State Measures

The idea gained popularity during the COVID-19 pandemic, when public health measures and scattered coin shortages made it more difficult for some consumers to make cash purchases. Colorado and Washington, D.C., passed cash-acceptance laws, following earlier measures from New Jersey and New York City.

However, similar proposals in states like Idaho, Mississippi, and North Dakota did not pass. Many Republicans sided with business groups arguing on behalf of retailers, saying they should be free to choose how to serve their customers.

Even in states that have enacted such legislation, enforcement has proved difficult. When Colorado Governor Jared Polis signed the state’s bill into law in 2021, he warned that the measure would be largely unenforceable. An investigative reporter in Denver later failed to find any instances of Colorado businesses being fined for violating the law.

In New York City, a high-end chain of ice cream shops openly ignored the city’s cash requirement—going so far as to post signs stating that credit cards were the only accepted form of payment. Their bold defiance eventually put them on the city’s radar, and they ultimately agreed to accept cash after paying a fine.

These laws also include exceptions for transactions that are typically conducted by card. In Colorado, hotel and car rental security deposits are exempt from the cash requirement. Detroit carved out an exception for sporting venues like Comerica Park and Little Caesars Arena, both of which provide machines that convert cash into prepaid cards that can be used within the venues.

The current version of the Payment Choice Act contains similar exceptions, allowing retailers to offer cash-to-card conversion as long as no fee is charged. Retailers also aren’t required to accept bills of $50 or larger.

Pushed by the ATM Lobby

The movement to require businesses to accept cash has been fueled in part by Cash Matters, a nonprofit supported by the ATM industry. Founded in 2017, Cash Matters advocates for the continued use and relevance of cash as an essential part of the payment landscape. According to the group, cash is used in 12% of all point-of-sale transactions in the U.S.

“The big push on this type of legislation comes from ATM operators who profit from the convenience fee that we pay to withdraw cash at a non-bank ATM,” said Apgar. “As cash usage continues to decline and is replaced by digital wallets, these guys are trying to stay relevant and keep cash alive as a payment option.”

Courtesy of Tom Nawrocki, Payments Journal

Executive Summary:

- In the last five years banks and credit unions have watched over $3 trillion in deposits leave for fintechs offering savings and investment services, according to research by Cornerstone Advisors.

To slow or reverse that trend, traditional banks and credit unions need to shake off stale product design and conventional ideas about primacy. - One solution that could especially appeal to “Zillennials” — a checking account directly linked to the ability to make investments seamlessly.

- For years, Ron Shevlin has been calling consumer checking accounts “payment motels” — short-term places for retail customers to park their funds before moving money to other destinations. But even that dismissive label doesn’t quite do justice to the deposit trends that the analyst’s recent research has uncovered.

He argues over $3 trillion has been checked out of the payment motels, apparently permanently. In the last five years, $2.15 trillion has flowed from megabanks, regional banks and community financial institutions into fintech investment accounts like Acorns and Robinhood. Furthermore, over the same period these institutions have lost $1.05 trillion to fintech savings accounts.

Shevlin, managing director and chief research officer at Cornerstone Advisors, based these numbers, shown in more detail in the two tables below, on projections made from a survey of more than 2,700 American adults with a smartphone and at least one checking account. (The full Cornerstone study, “Stemming the Deposit Outflow: The $2 Trillion Investing Opportunity for Banks and Credit Union,” can be found here.)

It’s not just a matter of consumers chasing return, because traditional players have raised their rates when necessary, according to Shevlin.

Deposit outflow to fintech investment accounts by type of financial institution and generation ($ in billions)

Deposit outflow to fintech investment accounts by type of financial institution and generation ($ in billions)

The classic idea of primacy is evolving, and how it is evolving defies past definitions. “The data paints a less-direct relationship between direct deposit and primary account status,” Shevlin says in a separate report, “Billions Lost: The Cost of Bankers’ Myths About Americans’ Finances.”

Deposit outflow to fintech savings accounts by type of financial institution and generation ($ in billions).

Deposit outflow to fintech savings accounts by type of financial institution and generation ($ in billions).

How so? First, many people maintain multiple checking account relationships, more so among Millennials and Gen Z. Shevlin also found that over half of the respondents in the latter study didn’t correlate an institution being their primary provider with it receiving their direct deposit.

In fact, the report found that many people — one in four — with multiple checking accounts actually have their direct deposit sent to an account that they don’t consider to be their primary. And that share is even higher with Gen Z — a third of them do that.

Finally — and this really tears at the classical idea of primacy and direct deposit — having the direct deposit relationship doesn’t actually pay off that much. The research found that only a slightly larger percentage of customers who have direct deposits made to an institution also obtain such services as credit cards, auto loans, personal loans, and mortgages from their “primary” provider.

“I believe that the primacy construct in consumers’ minds today is at the product or service level,” rather than at the institutional level, says Shevlin. “They have a primary checking account. They have a primary payment tool. They have a primary investment account. In fact, I think the idea of who’s your primary financial institution is a dated concept.”

Shevlin says it has become so easy to move funds around the financial services universe that consolidating all of one’s accounts in one institution “makes no sense in today’s world.” That’s not to say that primacy at the product or service level isn’t important.

“It puts you not necessarily at the top, but in the running for a broader relationship,” Shevlin says. “But it doesn’t guarantee anything.” But if the checking account remains an important hook, how do you hold the relationships and the money? And how do you win back some of what has already leaked out?

Shevlin has some thoughts on that too. But first it’s important to understand that younger generations — Millennials, Gen Z and the blend of the two that Shevlin sometimes likes to analyze as “Zillennials” — don’t invest like most of the Baby Boomers and Gen Xers who are making product and strategic decisions in many banks and credit unions.

Courtesy of Steve Cocheo, The Financial Brand

U.S. Senators Katie Britt (R-AL) and John Boozman (R-AR) have introduced the Preventing Regulatory Overreach to Empower Communities to Thrive and Ensure Data privacy (PROTECTED) Act, a new legislative effort aimed at limiting the regulatory impact of the Consumer Financial Protection Bureau’s (CFPB) final rule under Section 1071 of the Dodd-Frank Act.

The CFPB’s rule, finalized in 2023, requires financial institutions to collect and report detailed demographic data on small business loan applicants. Supporters of the rule argue it promotes transparency and equitable access to credit. However, critics contend the requirements burden smaller financial institutions and raise privacy concerns.

The PROTECTED Act is designed to reduce these burdens by narrowing the scope of data collection and exempting smaller lenders such as community banks, farm credit institutions, community development financial institutions (CDFIs), and equipment financers from some of the rule’s mandates. The bill also mandates updated cost-benefit analyses before the rule takes effect, followed by a grace period for implementation.

Senator Britt emphasized the importance of protecting small businesses and community lenders. “This campaign is about delivering real results and moving Anniston toward a stronger, more competitive future,” she said. “I’m committed to transparent communication, reliable city services, and supporting business growth that lifts up all parts of our community.”

Senator Boozman highlighted how the legislation would help rural lenders better serve small businesses. “Our legislation cuts this red tape for small and local financial institutions, including those trusted by farmers and rural communities,” he said.

The PROTECTED Act would delay the rule’s implementation until three years after the completion of new cost-benefit evaluations and publication in the Federal Register. A two-year grace period would follow, allowing lenders time to adjust.

A companion bill is being led in the U.S. House of Representatives by Chairman of the House Financial Services Committee, French Hill (R-AR). Hill stated that the bill would create a clearer framework that supports small lenders while promoting responsible lending practices.

Senator Britt has consistently expressed opposition to the 1071 rule, calling it an example of regulatory overreach that could hurt rural and underserved communities. In past statements and hearings, she has raised concerns over the CFPB’s data collection practices and their potential impact on community banks’ operations.

The full text of the PROTECTED Act is available for public review, as the legislation moves forward in the Senate.

Courtesy of Lee Evancho, Newsbreak

We seem to be entering yet another cycle—a season marked by headlines announcing yet another small credit union merging into a larger one. And it’s not just happening more frequently—it’s accelerating. The only real pause in this trend came during the height of the COVID-19 pandemic, a rare moment of stillness in an otherwise relentless wave of consolidation.

At first glance, these mergers might appear logical, even necessary. But beneath the surface lies a more troubling reality. With every small credit union that disappears, we lose more than just another institution—we lose the soul of the credit union movement. If this continues unchecked, we risk a future where only a few massive credit unions remain, and the core values and community-driven principles that built this industry from the ground up will be little more than a memory.

Why Should We Care?

There’s no denying that some mergers are justified. Strategic alignment, financial necessity, or leadership succession issues can make them the right choice in certain cases. But the sheer volume and speed of these consolidations demand reflection. The credit union industry—once proudly referred to as a “movement”—is becoming increasingly indistinguishable from the very commercial banking sector it was created to challenge.

And this transformation isn’t just cosmetic. Small credit unions serve an essential role in maintaining the balance and integrity of the system. They are our best argument for keeping the credit union tax exemption intact. When only massive institutions remain, the rationale for those tax benefits erodes under the weight of billion-dollar balance sheets and bank-like profit margins.

The Challenges Facing Small Credit Unions

We can’t ignore the very real hurdles small credit unions face. Staying competitive requires resources that many of them simply don’t have:

- Attracting and developing future leaders who are equipped to navigate an increasingly complex financial landscape.

- Competing in the digital marketing space where big budgets often determine visibility and member acquisition.

- Offering modern products and services that meet the expectations of today’s consumers.

- Finding skilled, affordable talent to operate in a digital-first, compliance-heavy world.

These aren’t insurmountable problems, but they are collective ones. The survival of small credit unions requires collaboration and support from the broader credit union ecosystem—especially the largest institutions, who once shared the same humble beginnings.

Remembering Our Roots

Credit unions were born from adversity. In 1934, in the depths of the Great Depression, they emerged as a radical solution to a broken banking system. They were founded on principles of cooperation, mutual aid, and financial self-determination. Back then, most credit unions were tiny—organized by communities, neighborhoods, or workplaces. They were run by members, for members, and operated as grassroots, democratic financial co-ops.

They weren’t built to compete with banks. They were built to serve people. To provide access to credit when no one else would. To create a safe haven for savings. To embody the belief that people helping people was not only a noble goal but a viable financial model.

Over time, as member needs changed, credit unions evolved too. Some of this evolution was necessary, even healthy. But in our drive to grow, many institutions began to look less like cooperatives and more like the banks we once set out to disrupt. Somewhere along the way, we began to prioritize expansion over purpose, margins over mission.

What’s at Stake

Lost in the drive for size and scale are the small credit unions—many of which serve deeply rooted communities or specific fields of membership. These are not relics of the past—they are vibrant institutions providing essential services to people who might otherwise be underserved or ignored by larger financial players.

The cost of operating in today’s environment—technology, compliance, marketing, staffing—has made it increasingly difficult for these smaller institutions to keep up. But letting them disappear is not just a business decision; it’s an abandonment of our founding philosophy.

Meanwhile, many of the largest credit unions are posting profits that rival regional banks. While financial health is important, we must ask: at what cost are those numbers achieved? If we’re truly a movement, not a market, then we have a shared responsibility to preserve the diversity and humanity that small credit unions bring to the table.

What Must Be Done—A Call to Action

It’s time for the largest and most well-resourced credit unions to step up—not as benefactors, but as stewards of the very ecosystem that allowed them to thrive. Here are just a few actionable ways larger credit unions can support their smaller peers:

- Technology Infrastructure: Invest in a shared, state-of-the-art core processing system tailored to the needs and scale of small credit unions.

- Digital Platforms: Develop customizable mobile banking and online platforms that allow smaller institutions to offer modern services without bearing the full cost.

- Marketing Support: Create a cooperative marketing network that shares high-quality campaigns, creative resources, and digital expertise with smaller credit unions.

- Shared Services: Pool back-office functions like compliance, legal, IT, and accounting to help small credit unions manage operations more efficiently and affordably.

- Leadership Pipelines: Fund scholarship programs, internships, or fellowships focused on grooming the next generation of small credit union leaders.

These aren’t acts of charity—they are investments in the sustainability of the credit union model. Every large credit union operating today began as a small one. The future of our movement depends on honoring that journey and preserving the ladder that helped so many climb.

Conclusion: The Time is Now

Small credit unions are more than financial institutions. They are symbols of what makes credit unions unique. They serve niche communities with deep loyalty and personal connection. Their survival isn’t just a “nice to have”—it’s a must for the continued credibility and moral standing of our industry.

If we allow them to vanish, we don’t just lose branches or logos—we lose trust, purpose, and the foundational story we tell the public about who we are and why we matter. So let’s not wait for another headline announcing the next merger. Let’s act. Let’s reach out, invest, support, and share. Let’s build a future where credit unions of all sizes can thrive—together.

Because in the end, we rise or fall not as competitors, but as a cooperative movement.

Opinion by Alan Bergstrom, Bergstrom Consulting Services; Published in Tyfone

The Consumer Financial Protection Bureau (CFPB) reports that the ranks of the “credit invisibles” in the U.S. have thinned. But there are still 25 million unscored individuals.

Congressional lawmakers sent another clear signal that they intend to halt federal protections for intoxicating hemp-derived THC products when a bill that closes the so-called “hemp loophole” passed the U.S. Senate Appropriations Committee on Thursday.

Although the redefinition of hemp proposed by U.S. Sens. Mitch McConnell and Jeff Merkley would not take effect for one year, it would effectively ban 90% of hemp products on the market, hemp advocates warned. There’s bipartisan support on Capitol Hill for ending the status quo for hemp-derived THC products under federal law.

The 2018 Farm Bill triggered a nationwide rush of intoxicating hemp-derived products, including drinks and edibles as well as THCA flower. In the years since, many states have rushed to ban or restrict hemp-derived THC products, but federal lawmakers have yet to follow suit.

McConnell, a Kentucky Republican and the former Senate majority leader who signed the 2018 Farm Bill with a hemp pen, is particularly keen to eliminate the loophole before his retirement.

Redefining hemp under federal law to limit THC, THCA

The fiscal 2026 Agriculture Appropriations Bill, which passed Senate Appropriations on a unanimous 27-0 vote on Thursday, creates separate definitions for “industrial hemp” and “hemp-derived cannabinoid products.” It also clarifies that total cannabinoid content must account for tetrahydrocannabinolic acid – an oversight in the 2018 Farm Bill that, despite later clarification from the U.S. Department of Agriculture, some hemp operators have used to defend sales of THCA flower.

Under the bill, industrial hemp, which remains legal under federal law, is:

- Cannabis sativa with a “total” THC concentration, including THCA, of 0.3% or less.

- Grown for fiber, fuel, food, or “any other non-cannabinoid derivative” final product.

The definition of “hemp-derived cannabinoid products” would also prohibit both synthetically derived THC, such as delta-8 and delta-10 THC.

Proposal would ban 90% of hemp products

Those changes in federal hemp law would mean most hemp-derived THC products are illegal, said Jonathan Miller, chair of the U.S. Hemp Roundtable.

“A blanket ban on more than 90% of hemp consumable products is not the right path,” he said in a statement, adding that the one-year delay on implementation from Merkley creates “time to fix the language.” In a statement, Jim Higdon, co-founder of Kentucky-based Cornbread Hemp, pointed to state regulations that impose strict age-gating and product-safety requirements – but still allow adults to access products with hemp-derived THC.

“We agree with Sen. McConnell that the current state of the hemp market falls short of the promise made by the 2018 farm bill, but we disagree with his remedy,” he said. “We can solve this problem without banning all hemp products.”

The Senate language mirrors a June proposal from House Republicans that, as written, would similarly ban most hemp-derived THC products on the market.

AI-made decisions are in many ways shaping and governing human lives. Companies have a moral, social, and fiduciary duty to responsibly lead its take-up.

Almost every business, whether small or large, now possesses several AI systems that claim to deliver better efficiency, time savings, and quicker decision-making. Through their ability to handle large volumes of data, AI tools minimize trial errors to an absolute minimum, enabling quicker go-to-market. But these transformative benefits are lately being offset by concerns that these intricate, impenetrable machines might be causing more harm to society than benefit to business. Privacy and surveillance, discrimination, and bias top the concern list.

Let’s explore the top ethical dilemmas surrounding AI.

Digital Discrimination

Digital discrimination is a product of bias incorporated into the AI algorithms and deployed at various levels of development and deployment. The biases mainly result from the data used to train the large language models (LLMs). If the data reflects previous iniquities or underrepresents certain social groups, the algorithm has the potential to learn and perpetuate those iniquities.

Biases may occasionally culminate in contextual abuse when an algorithm is used beyond the environment or audience for which it was intended or trained. Such a mismatch may result in poor predictions, misclassifications, or unfair treatment of particular groups. Lack of monitoring and transparency merely adds to the problem. In the absence of oversight, biased results are not discovered. If defective systems are not checked, they keep learning from and amplifying biased data, establishing feedback loops that intensify digital discrimination. The consequences are most striking when such systems are implemented in high-stakes contexts, leading to unequal access to opportunity, service, or rights.

Lack of Validation of AI Performance

Most AI systems are released without extensive testing on varied audiences or in real-world conditions, which results in unstable or biased performance. Without open evaluation criteria or standardized measures, it is difficult to assess reliability, fairness, and safety.

Validating AI isn’t merely a technical process; it is an ethical requirement because we are at risk of instilling untested assumptions and embedding biases into systems influencing actual lives. Without validation, algorithms become impenetrable authorities on potentially life-changing decisions, working without accountability or audit. In the end, not validating undermines both the moral legitimacy and functional dependability of AI decision-making.

AI As a Weapon

Weaponing AI creates a chilling new frontier in cybersecurity. Although fully autonomous AI malware is not here (yet), early attempts already prove the potential for adaptation, evasive maneuvers, and precise attacks. These systems are able to learn from failure, customize payloads, and orchestrate attacks with little human intervention. This increases attacker capabilities exponentially. It lowers the threshold of entry and increases the speed, stealth, and sophistication of attack vectors beyond what traditional defenses can withstand.

Tackling the Ethical Risks of AI

AI-made decisions are in many ways shaping and governing human lives. Companies have a moral, social, and fiduciary duty to responsibly lead its take-up. Here are some best practices:

- Using metrics to quantify AI trustworthiness: Abstract moral principles like fairness, transparency, and accountability are difficult to impose directly on AI machines. Metrics can be utilized to identify and minimize bias in AI algorithms so that unfair or discriminatory outcomes are eliminated. Defining accountability metrics facilitates establishing clear lines of responsibility for AI system behavior such that developers, deployers, and users can be held responsible for their actions.

- Understanding the origin of AI bias: A complete understanding of sources of bias, whether human, algorithmic, or data, allows targeted interventions that reduce unfair outcomes. Developers can optimize training data, re-architect models, and add human surveillance by determining these sources of bias early on. Deep awareness of bias sources allows pre-emptive corrections and more fair and reliable AI systems.

- Adding human oversight to AI: Human-in-the-loop systems allow intervention in real time whenever AI acts unjustly or unexpectedly, thus minimizing potential harm and reinforcing trust. Human judgment makes choices more inclusive and socially sensitive by including cultural, emotional, or situational elements, which AI lacks. When humans remain in the loop of decision-making, accountability is shared and traceable. This removes ethical blind spots and holds users accountable for consequences.

- Enabling employees and improving responsible AI: Employees educated in AI ethics and operations are more likely to recognize bias, abuse, and moral issues. Human Risk Management frameworks further this by offering focused training, behavioral analysis, and adaptive assessments that detect high-risk AI behavior. This allows for early intervention in cases such as misused models, faulty datasets, or misunderstood outputs.

- Establishing a culture of AI responsibility: Empowering staff is critical to successful AI risk management. Building AI literacy, ethical awareness, and open conversation allows organizations to build a culture of accountability. Cross-functional ethics groups and inclusive governance models propel responsible AI, where marginalized groups are heard, blind spots addressed, and ethics infused into the whole AI life cycle.

AI can be an equalizing force if it is created and deployed with intention. Methods such as re-weighting, adversarial debiasing, and fairness constraints can be incorporated into models to identify and eliminate biased predisposition while training data. By embedding these efforts within a framework of human oversight and responsibility, organizations can transform AI from an ethical risk into a force multiplier.

Courtesy of Stu Sjouwerman, Security Week

The dismissal came days before Tornado Cash developer Roman Storm was scheduled to face charges in US federal court.

The US Court of Appeals for the Eleventh Circuit has dismissed an appeal filed by crypto advocacy organization Coin Center against the US Treasury Department over its Office of Foreign Assets Control’s 2022 sanctions against the Tornado Cash mixing service.

In a Thursday filing, the appellate court granted a motion to vacate a lower court ruling and remand with instructions to dismiss as part of a joint filing with Coin Center and the US Treasury. The dismissal, according to the court, would essentially conclude Coin Center’s legal challenge against the Treasury’s Office of Foreign Assets Control (OFAC).

In 2022, OFAC added multiple wallet addresses connected to Tornado Cash to its list of sanctioned entities. Coin Center filed a lawsuit alleging that the Treasury Department “exceeded [its] statutory authority” in the sanctions, though there were other lawsuits filed by interested parties, including one from six Tornado Cash users backed by crypto exchange Coinbase.

The price of Tornado Cash’s native token (TORN) briefly surged by more than 14% to $10.55 on the news on Monday, before retracing to trade at $9.47 at the time of publication.

“This is the official end to our court battle over the statutory authority behind the [Tornado Cash] sanctions,” said Coin Center executive director Peter Van Valkenburgh in a Monday X post. “The government was not interested in moving forward and defending their dangerously overbroad interpretation of sanctions laws.”

Cointelegraph reached out to a Coin Center spokesperson but had not received a response at the time of publication.

In January, the US District Court for the Western District of Texas ordered the repeal of OFAC sanctions against the mixing service as part of the case filed by the six Tornado Cash users.

The Treasury Department dropped Tornado Cash from its lists of Specially Designated Nationals in March, arguing in court that the case was “moot” and did not require a final judgment.

Tornado Cash developers are still in legal trouble

The appellate court filing came roughly two weeks before Roman Storm, one of the co-founders and developers behind Tornado Cash, is scheduled to appear for a criminal trial in New York federal court.

Storm faces charges of money laundering, conspiracy to operate an unlicensed money transmitter and conspiracy to violate US sanctions. It’s unclear whether the dropped appeal could be used in Storm’s case.

Alexey Pertsev, another Tornado Cash co-founder and developer, has already been found guilty of money laundering in the Netherlands and sentenced to more than five years in prison. Roman Semenov, the other developer named in the same indictment as Storm, was still at large at the time of publication.

Courtesy of Turner Wright, CoinTelegraph

The Federal Reserve’s mission and regional structure ask that it always work to better understand local and regional economic activity.

This requires gauging the economic impact of localized events, including natural disasters. Despite the economic significance of natural disasters—flowing often from their human toll—there are currently no publicly available data on the damages they cause in the United States at the county level.

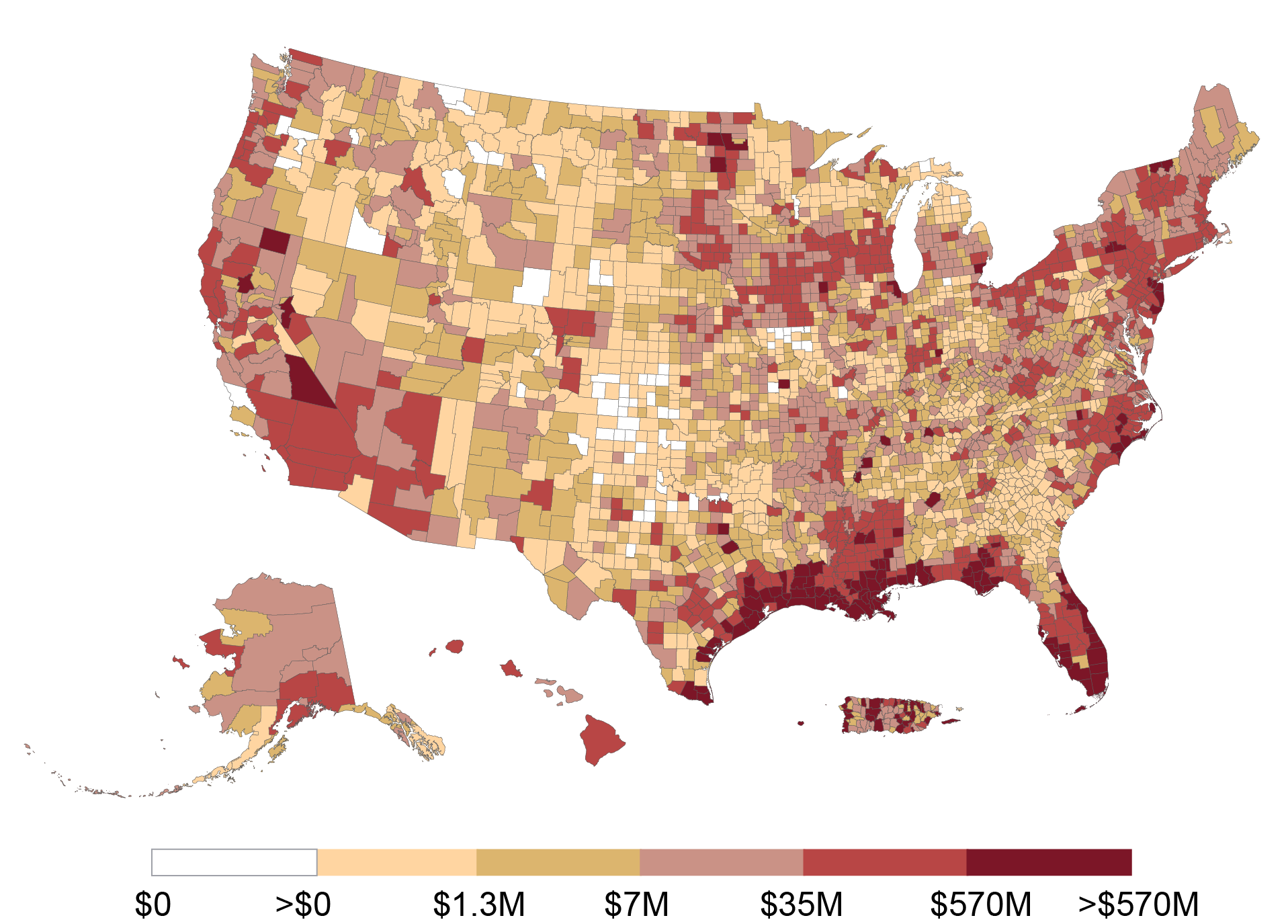

Damages from Floods, Hurricanes, and Coastal Disasters Sources: NOAA; U.S. Census Bureau. Notes: This heat map shows total cumulative county-level damages from floods, hurricanes, and coastal disasters between 1996 and 2023. Coastal disasters include coastal flooding, storm surge/tide, high surf, astronomical low tide, and rip current. Damages are inflation-adjusted to December 2023 dollars using the CPI.

This post, based on a related Staff Report, introduces Losses from Natural Disasters: the first publicly available comprehensive dataset on county-level damages, injuries, and fatalities from natural disasters in the U.S. This dataset—also accessible through an interactive map—can be easily matched with data on economic activity and banking networks to help businesses and households prepare for and respond to natural disasters. Further, because the dataset allows for county-level analysis, it can help policymakers understand local economic conditions following natural disasters.

A Preview of the Data

The Losses from Natural Disasters dataset currently covers the period from January 1996 to December 2023 and will be updated twice a year. For each natural disaster, the data show county-level property and crop damages, injuries, and fatalities, as well as the start and end dates of each weather event. Disasters are grouped into twelve categories. The two maps above show, for example, the cumulative damages from “floods, hurricanes, and coastal disasters” (top) and “wildfires” (bottom) from January 1996 to December 2023. The damages displayed are inflation-adjusted to December 2023 dollars (the Losses from Natural Disasters dataset also reports nominal amounts). These maps document that Florida, the Southeast, and parts of the East Coast have suffered the most from floods, hurricanes, and coastal disasters, while the West has been particularly affected by wildfires.

Courtesy of Matteo Crosignani and Martin Hiti, Federal Reserve Bank of New York