Aug. 23, 2019 NASCUS Report

Posted August 23, 2019THIS WEEK: Appeals court backs FOM rules (mostly); Praise from both sides; NASCUS notes value of competitive charter; Guidance gives thumbs up to hemp business services; NASCUS advises caution; new interstate banking deal in works — and more!

Appeals court sides with NCUA

over FOM regulations (mostly)

In vindication of its rules on field of membership, NCUA was handed a near-complete victory by a federal appeals court this week in a lawsuit brought by the banking industry over the agency’s membership regulations.

NASCUS congratulated the federal credit union regulator (see item below).

The U.S. Court of Appeals for the D.C. Circuit overturned a lower court’s decision from last year in American Bankers Association v. NCUA that vacated provisions of the agency’s 2016 field of membership rules. The appeals court found that provisions of the rule on combined statistical areas and rural districts are reasonable, overturning a March 2018 district court ruling that found the provisions “arbitrary and capricious.” That decision allows credit unions to serve Combined Statistical Areas of up to 2.5 million people and rural districts with up to 1 million people.

However, while the appeals court upheld NCUA’s rules regarding core-based statistical areas (which the lower court had also upheld last year), it remanded the provision, giving the agency time to consider the “discriminatory impact it might have on poor and minority urban residents.” After that consideration, the agency could choose to either address the court’s concerns or rescind the provision altogether.

In any event, NCUA Board Chairman Rodney Hood, in a statement, said the agency was pleased, overall, with the appeals court decision. “In the near future, we will provide guidance for affected credit unions,” Hood said. (Last year, following the lower court decision, NCUA said that it would not grant any new community charters under the vacated rule provisions while the order is in effect. NCUA said it also instructed affected credit unions during that time not to accept any new members who would only be eligible for membership under those provisions.)

Praise from both sides for ruling

Credit union groups praised the appeals court decision. “This will have a positive impact for the industry’s 117 million members and American consumers who now have better access to member-owned not-for-profit credit unions,” said a joint statement issued by the Credit Union National Association (CUNA), National Association of Federally-insured Credit Unions (NAFCU) and CUNA Mutual Group. “For the one aspect of the rule that the court asked for more explanation, we are confident the agency will provide additional support.”

For its part, the banking industry declared a modicum of victory too. Noting the remand of the provision core-based statistical areas, the American Bankers Association argued that the court “saw merit” with the bankers’ position that the provision would encourage redlining by allowing credit unions to construct fields of membership consisting of wealthier suburbs without lower-income core neighborhoods.

The future of the lawsuit is unclear: the ABA said only that it was reviewing the rule as it “determines its next steps.”

LINK:

Decision: U.S. Court of Appeals for D.C. Circuit: ABA v. NCUA (field of membership)

NASCUS: Competitive charter key to dual system

In a release of its own following the announcement of the appeals court’s ruling on NCUA membership rules lawsuit, NASCUS congratulated NCUA on the near-complete win. “We commend the agency’s efforts to maintain an effective federal charter,” said NASCUS President and CEO Lucy Ito. “We have long held that a competitive federal charter is vital to preserving a robust dual charter system and today’s ruling certainly advances that goal,” she added.

Guidance: OK to serve to hemp businesses …

Guidance that allows federally insured credit unions to provide the “customary range” of financial services – including loans — to legally operating hemp businesses in their fields of membership was published by NCUA this week.

“The information in this alert is intended to help credit unions better understand what they should consider in providing financial services to lawfully operating hemp businesses,” NCUA stated in the guidance. The agency also said the guidance will be revised and updated when the Department of Agriculture finalizes its rules and guidelines. The agency gave no timeline for when that might occur.

In a statement, NCUA Board Chairman Rodney Hood said he expects credit unions will “thoughtfully consider” their ability to safely and properly serve legal hemp-related businesses within their customer bases (known by credit unions as “field of memberships.”)

“Lawful hemp businesses provide exciting new opportunities for rural communities,” Hood said. “I believe today’s interim guidance keeps with the mission of the nation’s cooperative credit system to serve people who have been overlooked and underserved. Many credit unions have a long and successful history of providing services to the agriculture sector.”

Sen. Majority Leader Mitch McConnell (R-Ky.), in a separate release, asserted that the guidance was released by the agency at his request. ““I’m delighted to hear the NCUA has answered my call on behalf of Kentuckians to ensure the legal hemp industry can access much-needed financial services,” McConnell stated, also noting the difficulty many of his constituents in receiving loans and other services for running their hemp business.

LINK:

NCUA Releases Interim Guidance on Serving Hemp Businesses

… NASCUS commends action – but advises care be taken

In the wake of Hood’s statement, NASCUS commended the chairman’s action, but advised caution for credit unions, noting it remains illegal for credit unions to serve marijuana businesses.

“Hemp and marijuana look and smell the same and the difference is that hemp plants contain no more than 0.3% of THC (tetrahydrocannabinol),” said to Lucy Ito, NASCUS president and CEO. “Credit unions must consider the risks given the variability of hemp THC levels and licensure (mono-licensing) of hemp versus cannabis businesses. If a credit union, knowingly or unknowingly, serves a business operating in plants that exceed the 0.3% threshold, the credit union could be serving an illegal marijuana business and would thus be subject to penalties.”

Ito said the agency’s guidance on serving lawful hemp businesses provides credit unions with “helpful clarification and given the added complexity of hemp-related compliance, credit unions must weigh the potential exposure when deciding to serve hemp businesses.”

LINK:

NASCUS CEO Lucy Ito responds to NCUA’s release of interim guidance on serving hemp businesses

3rd generation interstate banking deal in works

A third generation interstate branching agreement is in the works in an effort to expand the breadth of past arrangements and to provide more clarity for the state credit union system, the top developer of the plan for NASCUS told the State System Summit last week.

(Parker Cann discusses the development of a third generation state system interstate branching/banking agreement at the NASCUS State System Summit last week.)

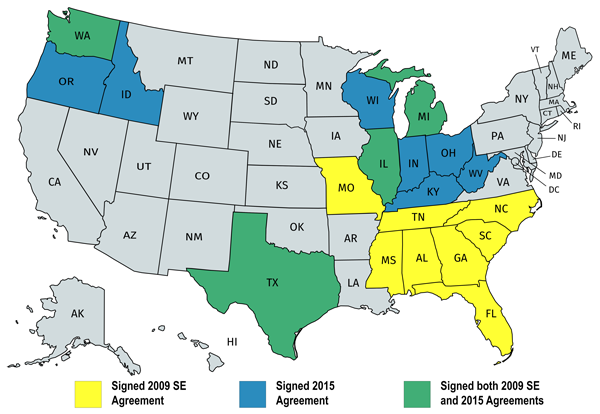

Former Washington state regulator and credit union executive Parker Cann said the third version of the agreement – which would be a successor to two previous agreements developed by NASCUS and signed (to date) by 21 states – is a “work in progress” that would give credit unions the ability to provide interstate services like banks, thrifts and federal credit unions do so now.

Cann told the Summit crowd that a new interstate agreement could identify state law differences affecting state credit unions’ interstate activities, and allow for the elimination of many of the conditions in the current agreements. “These kinds of refinements could reduce uncertainty and controversy among state supervisors and SCUs,” he said.

A key goal of the new agreement: require no changes in certain state laws, which could delay adoption of the agreement by states for an extended time, he said.

Current agreements developed by NASCUS and signed by states are the Southeastern Regional Cooperative Interstate Agreement (adopted in 1998, and updated in 2008) and the Nationwide Cooperative Agreement (adopted in 2015).

2015 Cooperative Interstate Agreement for the Supervision of State-Chartered Credit Unions

Summary highlights risk alert on biz email fraud

NASCUS has posted a summary of NCUA’s recent risk alert on business email compromise (BEC) fraud and related risks, and the steps that institutions should consider in order to mitigate the risk of falling prey to such scams. The summary is available to members only. Two weeks ago, NCUA issued the risk alert – its first since 2013 – which noted “the increasing frequency of and losses related to business email compromise fraud schemes, and that credit unions can take steps to prevent the fraud and report it, when it occurs, to the FBI’s Internet Crime Complaint Center.” The NASCUS summary highlights the key points made in the risk alert.

LINK:

NASCUS Summarizes First 2019 NCUA Risk Alert

Speaking of fraud: School takes a deep dive

Identifying and combatting fraud is the front-and-center topic for a one-day session next week (Tuesday) in Ann Arbor, Mich., sponsored by NASCUS. The NASCUS Fraud School, in addition to teaching recognition and prevention of fraud, looks at cases of employee deception, dishonesty, and embezzlement schemes. Participants will hear real-life loss scenarios, identify key warning signs to look for, and learn which loss controls should be implemented to hold individuals responsible for their actions and minimize operational and reputational risk. Registration is still open; see the link below

LINK:

NASCUS 2019 Education Agenda

BRIEFLY: Alert draws attention to fentanyl financing schemes; no NR next week, back first week of September; have a great Labor Day holiday!

Financial schemes for laundering the proceeds from illegal sales of the drug fentanyl and other synthetic opioids are the subject of an advisory issued Wednesday to financial institutions by the Treasury Department’s top office for fighting financial crime, the Financial Crimes Enforcement Network (FinCEN). The advisory outlines the trail that illegal transactions for the drugs typically follow, the opportunities for money laundering that exist in that route, case studies on illicit finance, red-flag indicators, the role of information collected through suspicious activity reports (SARs), and a reminder of “regulatory obligations for U.S. financial institutions.” … NASCUS Report is taking a break next week (Aug. 30), but will resume publication the first week of September (Sept. 6); in the meantime … Have a terrific (and safe) Labor Day holiday!

Information contact: Patrick Keefe ([email protected])

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.