Jan. 15 ’16 NASCUS Report

Posted January 15, 2016McWatters expects to ‘remain engaged’

with NCUA during nomination process

In a move this week that took many state regulators and credit unions by surprise, President Obama nominated NCUA Board Member J. Mark McWatters to join the board of the Export-Import Bank of the U.S. The nomination was officially sent to the Senate Monday evening. A member of the NCUA Board since 2014, McWatters before that served as Director of Graduate Programs and as an adjunct professor at the Southern Methodist University (SMU) Dedman School of Law. He was also an adjunct professor at SMU’s Cox School of Business.

In a move this week that took many state regulators and credit unions by surprise, President Obama nominated NCUA Board Member J. Mark McWatters to join the board of the Export-Import Bank of the U.S. The nomination was officially sent to the Senate Monday evening. A member of the NCUA Board since 2014, McWatters before that served as Director of Graduate Programs and as an adjunct professor at the Southern Methodist University (SMU) Dedman School of Law. He was also an adjunct professor at SMU’s Cox School of Business.

In a statement this week, McWatters noted he “intends to remain fully engaged” on matters coming before the NCUA Board during the confirmation process for his nomination. Until he is confirmed for the Ex-Im board, he stated, “I will continue to work on the critical regulatory issues and policies facing the credit union system as a member of the NCUA Board.” His work for NCUA may continue for a while — in comments to Washington press this week, Senate Banking Committee Chairman Richard Shelby (R-Ala.) indicated he is in “no hurry” to hold nomination hearings, given it is election season. The Banking Committee has jurisdiction for confirmations of both Ex-Im Bank and NCUA nominees.

McWatters has “expended considerable effort to bring greater transparency and accountability to the NCUA Board and to the agency generally during his tenure – which NASCUS applauds,” NASCUS President and CEO Lucy Ito said in a statement this week. She noted, further, that he has worked to facilitate equitable acknowledgement of the needs of both federal and state charters, demonstrating recognition of the importance of the dual chartering system, and that NASCUS thanks him for his service.

LINKS:

NASCUS President/CEO Lucy Ito on nomination

McWatters statement on being named to Ex-Im Bank board

… REPLACEMENT SHOULD HAVE STATE REGULATOR EXPERIENCE

An impending vacancy on the NCUA Board is our opportunity to urge the Obama Administration, and lawmakers, to strongly consider nominating someone with state regulatory experience to the open seat (or any others that open up this year). NASCUS has long advocated that legislation be adopted to require that at least one seat on the NCUA Board be designated for a member with state credit union regulatory experience. NASCUS also advocates that the NCUA Board be expanded by law to a total of five members from its current three. Ensuring a seat for someone with state supervision experience, in our view, would best serve the federal-state credit union regulatory partnership. It would mitigate the effect of NCUA’s inherent conflict of interest as both the insurer and charterer/regulator of federal credit unions and serve as a check on any tendency for NCUA to favor federal credit unions as insurer of both state and federal credit unions and as the sole charterer/regulator of federal credit unions. We will look for every opportunity to bring this approach to the administration and Congress for consideration.

LINK:

NASCUS priorities for 2016 (Jan. 8 NASCUS Report)

OTR NOTICE, COMMENT ON AGENDA FOR ACTION

When the NCUA Board at its Thursday meeting considers, and votes, to publish the overhead transfer rate (OTR) methodology in the Federal Register and seek public comment, it will be the first time that state regulators and credit unions will have the chance to weigh in – officially – on the direction the funding mechanism is headed. Over the last several years, at the least, that direction has been upward.

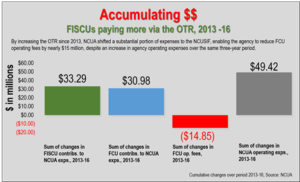

An analysis by NASCUS of numbers on NCUA’s website shows that, in the period 2013-16, the federally insured, state-chartered (FISCU) portion of NCUA’s insurance cost (which is what the OTR is designed to cover) totaled $349.2 million; the FCU portion, over that time, totaled $398.4 million. (And, since 2010, at least $1 billion has been transferred from the insurance fund to cover NCUA’s expenses.) However, further analysis indicates that, over that time period, NCUA shifted a substantial portion of its expenses to the insurance fund, enabling the agency to reduce operating fees for FCUs (by nearly $15 million), despite increases totaling $49 million in NCUA’s operating expenses over the same period.

An analysis by NASCUS of numbers on NCUA’s website shows that, in the period 2013-16, the federally insured, state-chartered (FISCU) portion of NCUA’s insurance cost (which is what the OTR is designed to cover) totaled $349.2 million; the FCU portion, over that time, totaled $398.4 million. (And, since 2010, at least $1 billion has been transferred from the insurance fund to cover NCUA’s expenses.) However, further analysis indicates that, over that time period, NCUA shifted a substantial portion of its expenses to the insurance fund, enabling the agency to reduce operating fees for FCUs (by nearly $15 million), despite increases totaling $49 million in NCUA’s operating expenses over the same period.

NASCUS leader Lucy Ito recommended that state regulators and credit unions keep these points in mind as they consider responses to NCUA’s call for comments – which she also urged all principals in the state credit union system to do. “In our view, the OTR has become an inequitable distribution, favoring the FCU over the state charter by lowering FCU operating fees and reallocating a significant portion of the expense related to FCU supervision to the NCUSIF, which is also funded by state-chartered credit unions. If the dual-chartering system is to thrive – and we know it should — that favoritism must come to an end. The state system can help ensure that by letting its voice be heard during the upcoming comment period on the OTR.”

Also on the agenda for next week’s NCUA Board meeting: The agency’s 2017-21 strategic plan; notice and comment of the FCU operating fee methodology, and; a final rule on the Office of Minority and Women Inclusion reporting structure.

LINKS:

OTR Resources

NCUA Board Jan. 21 agenda

Higher-res version of chart

CYBER-SECURITY, BSA AMONG TOP NCUA 2016 REG PRIORITIES

Cyber-security assessments and protecting member data lead off the six areas of “supervisory priorities” for NCUA in 2016, according to a Letter to Credit Unions issued by the agency this week. Letter CU-16-01 is intended, NCUA states, to assist credit unions in preparing for their next NCUA examination, and calls that the top six areas of supervisory focus “broadly applicable for credit unions in 2016.”

The six priorities outlined in the letter are: cyber-security assessments; response programs for unauthorized access to member information; BSA compliance; Interest-rate risk; TILA-RESPA Integrated Disclosure Rule, and; CUSO reporting (which will be subject of a Letter to Credit Unions expected to be released soon).

Additionally, the letter notes that NCUA field staff will continue to use the streamlined small credit union exam program procedures for credit unions with assets up to $50 million and CAMEL ratings of 1, 2, or 3. “For all other credit unions, field staff will conduct risk-focused examinations, which concentrate on the areas of highest risk, new products and services, and compliance with federal regulations.”

NASCUS offers two in-depth programs on its 2016 educational calendar that take on two of the top three NCUA priorities: Cybersecurity and BSA compliance; see the links below for more information.

LINKS:

NCUA LTCU 16-CU-01

2016 Cybersecurity Symposium

2016 BSA Conference

REGULATOR DROPS INVESTMENT MANDATES FOR FHLB AFFILIATION

Following NASCUS’s recommendation, credit unions and other financials would not have to hold a certain percentage of assets in mortgages in order to qualify for Federal Home Loan Bank (FHLB) membership, under new rules issued Tuesday by the Federal Housing Finance Agency (FHFA). Under the rules, each FHLB member would not be required to hold 1% of its assets in “home mortgage loans” on an ongoing basis, as originally proposed. Additionally, each member would not be required to comply, on an ongoing basis, with a requirement (for credit unions and non-community financial institutions) that it hold at least 10% of its assets in “residential mortgage loans,” also as originally proposed.

FHFA Director Melvin L. Watt in a press release stated that “the statutory requirements for members to continue their commitment to housing finance can be addressed by monitoring the levels of residential mortgage assets they hold and we, therefore, decided not to include the ongoing investment requirements in the final rule.”

In its comment letter early last year, NASCUS argued that both of the requirements should be revisited by the FHFA before finalizing the rules. “In our view, the proposed requirements would hamper the ability of some institutions to manage interest rate risk and reduce the availability of liquidity in the credit union system,” NASCUS wrote.

LINK:

NASCUS comment letter on Federal Home Loan Bank Membership

FHFA press release on new rules

BRIEFLY: CECL around the corner; CFPB webinar

The Financial Accounting Standards Board (FASB) is expected any day this quarter to release its final Current Expected Credit Loss (CECL) model, which essentially will require financial institutions to change the way they approach their reserve processes by replacing an incurred loss approach with a lifetime expected loss estimate; implementation isn’t until 2019 at the earliest … NCUA Board Chairman Debbie Matz will host a joint webinar with CFPB Director Richard Cordray on Tuesday, Feb. 9, beginning at 3 p.m. ET; it’s the fifth annual such event.

Information Contact:

Patrick Keefe, NASCUS Communications, pkeefe@nascus.org or (703) 528-5974

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.