Sept. 30, ’16 NASCUS Report

Posted September 30, 2016NCUA moving forward on OTR;

Profile shows accountability in states

NCUA is moving forward on considering the future of the overhead transfer rate (OTR), NASCUS has learned, and the association is working with state supervisory authorities to help coordinate and assist with providing state information to the federal agency. The OTR is the amount of money that is transferred (usually annually) from the National Credit Union Share Insurance Fund to the agency’s budget to help cover “insurance-related expenses.” The OTR is traditionally approved by the NCUA Board – as is the overall NCUA budget (with no additional oversight).

learned, and the association is working with state supervisory authorities to help coordinate and assist with providing state information to the federal agency. The OTR is the amount of money that is transferred (usually annually) from the National Credit Union Share Insurance Fund to the agency’s budget to help cover “insurance-related expenses.” The OTR is traditionally approved by the NCUA Board – as is the overall NCUA budget (with no additional oversight).

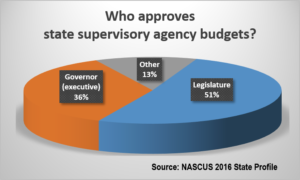

An important distinction for state supervisory agencies is that their budgets are subject to oversight within their respective states – typically either by the chief executive (the governor), the legislature or more. According to the NASCUS 2016 State Profile (compiled this summer), more than four in five states responding (87%) must have their budgets approved by either the governor or the state legislature. The remainder of the states reporting must have their budgets approved by both the governor and the legislature, a commission, the head of the individual agency – or (as in Alaska), the legislature appropriates funds and the governor has the ability to make line-item amendments.

NCUA has scheduled a budget briefing on Oct. 27. The briefing – which will focus on the 2017 agency budget, a draft version of which, NCUA said in a statement, will be released the week of Oct. 9 – is being billed as a method for stakeholders to use in bringing constructive comments “to the table,” NCUA Board Chairman Rick Metsger has stated.

NASCUS is considering its options for participating in the briefing — which could be an opportunity to discuss the future of the role of the overhead transfer rate in the agency’s funding process. The agency collected comments on the OTR this past spring, with nearly all submitted comments calling for changes to how the funding system works, especially in the transparency of transfers made. Additionally, legislation has been introduced in Congress (H.R. 5869, sponsored by Reps. Mick Mulvaney, R-S.C., and Denny Heck, D-Wash.), which calls for a rationale for any amounts NCUA proposes to use from the National Credit Union Share Insurance Fund, among other things.

SUMMIT NOTES: State system Summit opens next week in Chicago

A governor, a member of Congress, both NCUA Board members and hundreds of state credit union system supporters gather in Chicago next week for the NASCUS State System Summit, Wednesday through Friday, to participate in dialog, discuss issues and share ideas about current events and the future. The 2016 Summit features more than 20 hours of networking, discussion, educational sessions and more over its three-day span. Illinois Gov. Bruce Rauner (R), U.S. Rep. Randy Hultgren (R-Ill.), NCUA Board Chairman Rick Metsger and NCUA Board Member J. Mark McWatters are all scheduled to speak during the event. Top issues to be discussed include the 2016 presidential and congressional election campaigns, the future of commercial lending (particularly in light of the new NCUA MBL rule going into effect next year), recent actions (and those to come) in state legislatures affecting the state CU system, the new CECL accounting standard, the rise of fintech – and much more, including a special session on demystifying private share insurance. Highlights of the Summit will be reported next week on the NASCUS website, and in this report at the end of the week.

LINK:

Agenda/speakers for 2016 NASCUS State System Summit

STOPGAP FUNDING BILL PASSES, BUT WITHOUT CHANGES FOR CFPB

As Congress raced to recess in advance of the November election, it took time to take action to ensure the federal government had funding – at least until Dec. 9 – but without key provisions contained in appropriations bills, including changes to the CFPB governing structure. This summer, the House passed the Financial Services and General Government (FSGG) Appropriations Act for FY 2017, which included (among other things) a provision that would change the CFPB leadership to a 5-person board (from its current director) and place the agency under the appropriations process. However, the funding bill adopted by Congress this week – to avoid a government “shutdown” – did not contain that provision. It could still be considered when Congress returns following the election in mid-November for a “lame duck” session (scheduled to run through Dec. 16). A similar provision that would change the NCUA Board to five members (from its current three), and place the agency budget under the congressional appropriations process, is contained in the Financial CHOICE Act (HR 5983) adopted by the House Financial Services Committee earlier this month. The bill awaits further action in the House.

SUPERVISORY LETTER LOOKS AT OVERSIGHT OF CDFI CUS

Information about the supervision of credit unions recognized as “community development credit unions” (CDFIs) has been provided by NCUA to its staff, with the intent of establishing “a consistent framework for the exam and supervision process.” Dated Sept. 19 (and released this week by the agency), NCUA Supervisor Letter SL No. 16-01 applies to all CDFI credit unions. It includes background, exam and supervision procedures, grant accounting guidance, and a list of previously issued NCUA guidance related to CDFI CUs. It also includes an attachment dealing with accounting for CDFI CUs. The agency wrote that it recognizes and accepts that there are “risks inherent” in the business model of CDFIs. “A CDFI-certified credit union, much like a low income designated credit union, may have a very different risk profile than other credit unions,” the agency guidance states. “A CDFI-certified credit union often needs to assume different risks in the types of member service programs they employ to achieve their community development mission. NCUA’s focus is not on avoiding these risks, but rather on ensuring CDFI-certified credit unions adequately manage the risks.”

LINK:

NCUA Supervisory Letter 16-01: CDFI-certified CU supervision

‘EXAM GUIDE’ WEBSITE SCHEDULED FOR ROLLOUT

An updated “NCUA Examiner’s Guide” website is scheduled to debut next week, with four chapters in the initial rollout, as a result of decisions made by the NASCUS/NCUA National Examination Committee (NEC) meeting last week in the Washington, D.C., area. Chapters included in next week’s planned rollout are: Fidelity Bond Coverage, Interest Rate Risk, Risk-Focused Examination Program, and the Total Analysis Process. Other chapters will be published on a rolling basis thereafter, with a chapter on member business lending (MBL) planned to be finalized in the next few months. The joint committee gathers comments from examiners regarding the examiners’ guide, exam process and procedures, emerging issues affecting exams and other issues. NASCUS State representatives on the committee are Denise St. Pierre (NH), Dawn McCaskill (GA) and Edward Schutte (OR).

MEASURE STREAMLINING CA CHARTER SIGNED INTO LAW

Member business loans could exceed a member’s deposits, and an audit committee in lieu of a supervisory committee would be allowed – among other things — under California legislation streamlining the state’s credit union charter that was signed into law recently by the state’s governor. In addition to those two provisions, the bill (A 2274) would also: eliminate requirement of board approval of membership applications; allow non-members to act as the co-borrower, surety, or guarantor of a loan made to a member; redefine which credit union officials’ loans are subject to certain limitations and are required to be reviewed by the board; allow credit unions to decide whether their boards need to meet on a monthly basis, or if they should opt to meet less often based on the needs of the credit union, and; remove unnecessary loan documentation requirements. The provisions take effect Jan. 1

BRIEFLY: Small dollar loan proposal; CUAC in video; L&R committee meets; change in SC

Comments are due a week from today (Oct. 7) on CFPB’s “small dollar loan” proposal (also known as the proposed rule on “Payday, Vehicle Title, and Certain High-Cost Installment Loans.” See the NASCUS CFPB resource center (link below) for more information … A video of the most recent meeting of the CFPB’s Credit Union Advisory Council (CUAC) has been posted by the agency and is ready for viewing (on YouTube) … Attending the Summit next week (or in the Chicago area)? Stop by the meeting of the NASCUS Legislative and Regulatory Committee – Tuesday, Oct. 4, at 11:45 a.m. (to 1:45 p.m.) at the Westin River North Hotel. See you there! …

the proposed rule on “Payday, Vehicle Title, and Certain High-Cost Installment Loans.” See the NASCUS CFPB resource center (link below) for more information … A video of the most recent meeting of the CFPB’s Credit Union Advisory Council (CUAC) has been posted by the agency and is ready for viewing (on YouTube) … Attending the Summit next week (or in the Chicago area)? Stop by the meeting of the NASCUS Legislative and Regulatory Committee – Tuesday, Oct. 4, at 11:45 a.m. (to 1:45 p.m.) at the Westin River North Hotel. See you there! …

More change is happening among state supervisors: South Carolina Commissioner Louie A. Jacobs has announced his retirement effective Monday (Oct. 3).

LINKS:

NASCUS CFPB resource center (small-dollar loans proposal)

Video of latest CUAC meeting of CFPB

Information Contact:

Patrick Keefe, NASCUS Communications, pkeefe@nascus.org or (703) 528-5974

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.